Kenorland Intersects 138.74 g/t Au over 3.15m at R5 and Announces New Vein Discoveries in Deeper Drilling at Regnault

May 31, 2023

Vancouver, British Columbia, May 31, 2023 – Kenorland Minerals Ltd. (TSXV: KLD) (OTCQX: KLDCF) (FSE: 3WQ0) (“Kenorland” or the “Company”) is pleased to announce initial drill results from the 2023 winter drill program at the Frotet Project, (the “Project”), located in northern Quebec and held under joint venture (the “Joint Venture”) with Sumitomo Metal Mining Canada Ltd. (“SMMCL”). Assays from 7 of 15 drill holes completed, including 6,681 meters of the 13,360-meter program are reported herein. The Company is also pleased to report the discovery of multiple additional mineralised vein structures encountered in deep drilling of the Regnault gold system.

Drill highlights include the following:

- 23RDD163: 15.00m at 14.88 g/t Au incl. 2.00m at 57.15 g/t Au at R1

- 23RDD167: 3.15m at 138.74 g/t Au incl. 0.40m at 476.40 g/t Au at R5

- 23RDD167: 3.43m at 43.23 g/t Au incl. 0.44m at 174.30 g/t Au at R5

- 23RDD162: 7.10m at 12.24 g/t Au incl. 1.70m at 45.14 g/t Au at R2-R8 Gap

- 23RDD159: 1.20m at 55.70 g/t Au (new vein discovery)

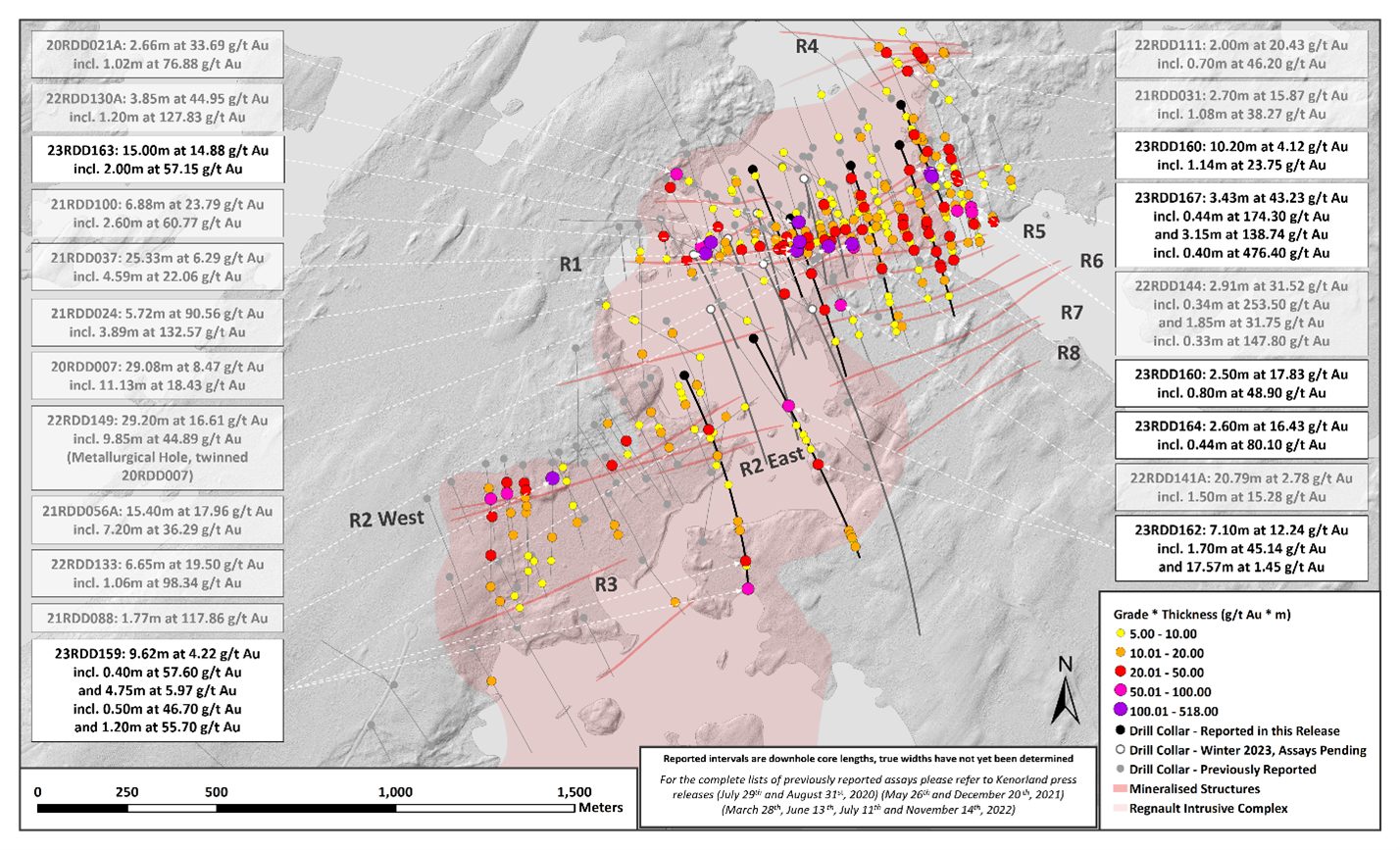

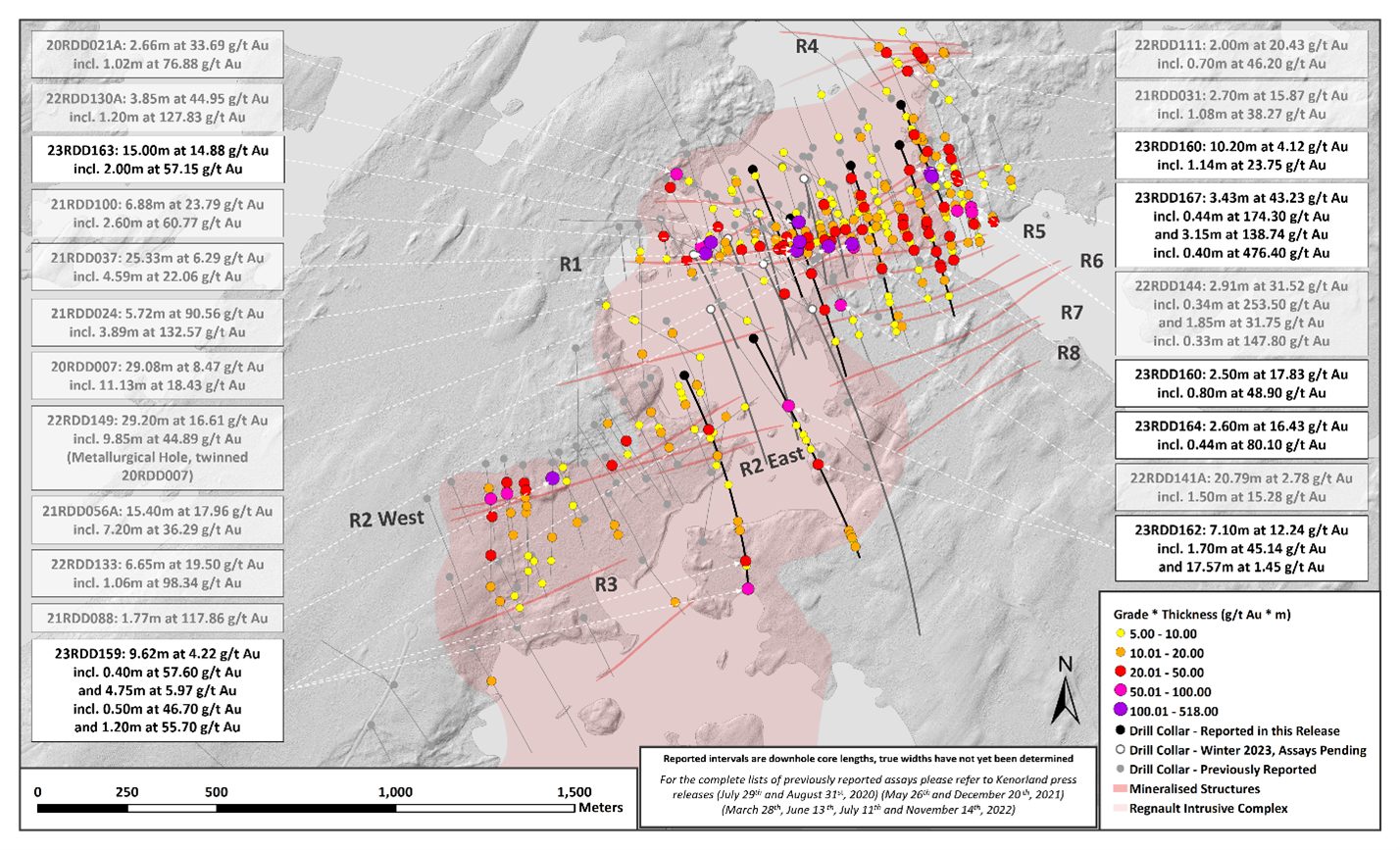

Figure 1. Plan map of Regnault drilling (previously reported, currently reported and assays pending)

Zach Flood, President and CEO of Kenorland, states, “Incredible work by the team on this program and throughout the discovery of this major gold system. As our geologists have been developing a robust geologic model, Regnault is becoming remarkably predictable in the sense of geometry and repetition of sub-parallel vein structures at depth. Given our continued success in finding new veins on each drill program, I believe the odds of further discoveries in the future is great, and we will continue to grow what is already a very large, high-grade gold system.”

Discussion of Results

The 2023 winter drill program was largely designed to test the strike and depth extent of multiple new vein discoveries made in 2022, including the R5, R6, R7, and R8 structures. Drilling was focused in an area between these new vein discoveries to the east and the R2 and R3 structures to the west, where there had been limited drilling to date. All drill holes intersected significant mineralisation across multiple structures, linking the eastern vein discoveries to the western structures, defining a corridor of up to 1.8 kilometers of strike containing multiple sub-parallel vein structures hosting high-grade gold mineralisation.

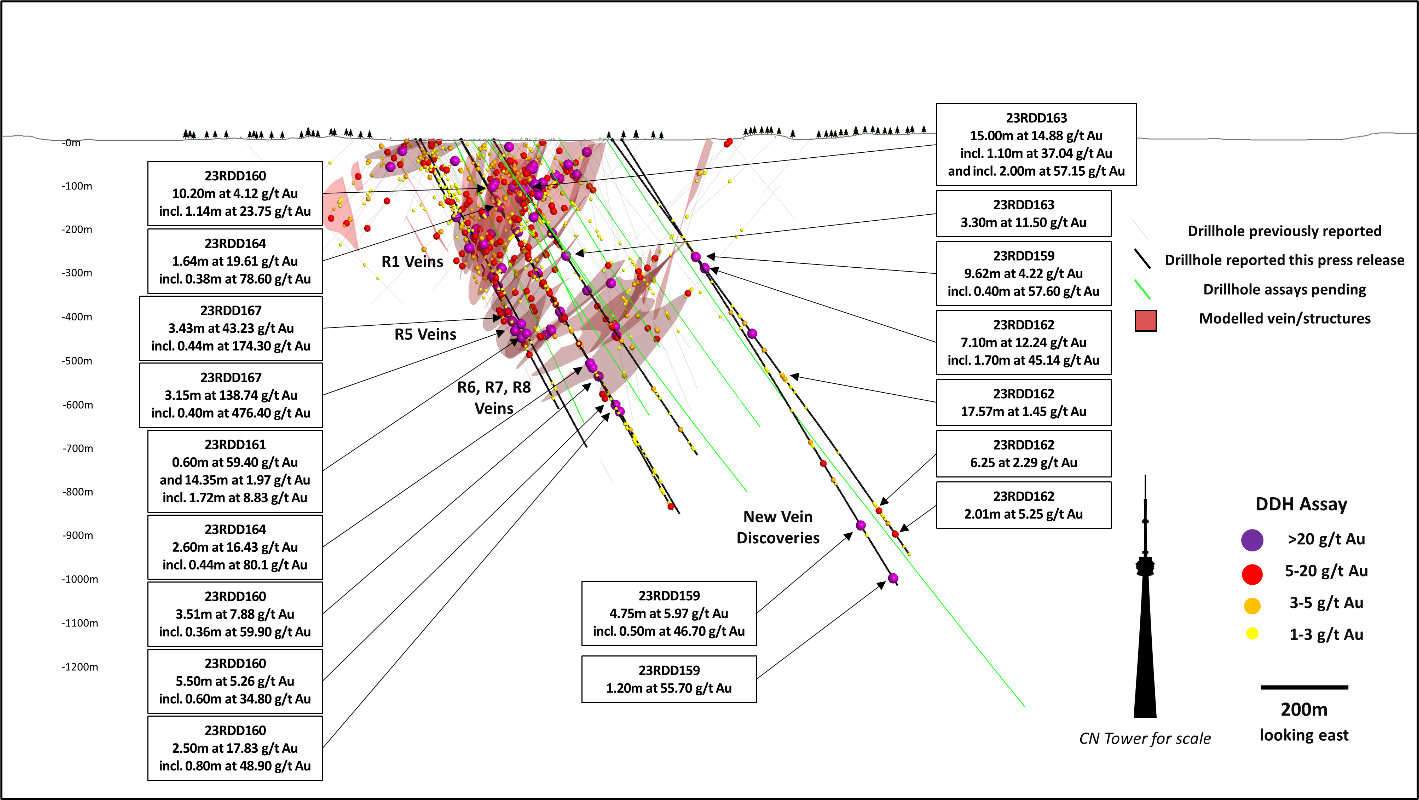

In addition to step-out and infill drilling along known structures, deep drilling was designed to explore for additional sub-parallel veins at depth and towards the south of known mineralised structures. The deep holes, up to 1,614m in length (1,250m vertical depth), successfully intersected multiple new vein discoveries, significantly extending the known footprint of the Regnault gold system to vertical depths of over one kilometer. 23RDD159 intersected 1.20m at 55.70 g/t Au, a new vein discovery, and the deepest known mineralisation returned to date at 1,000 meters vertical depth.

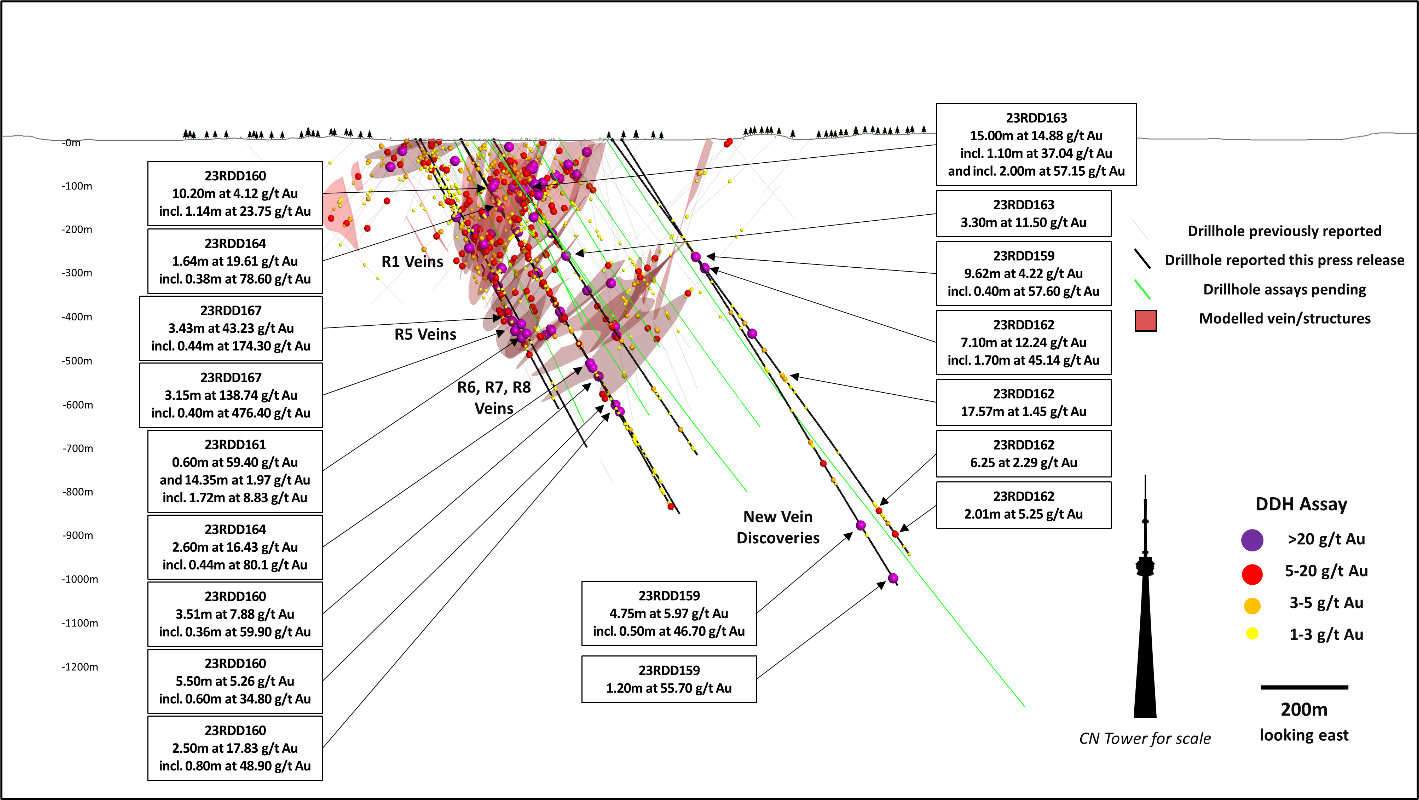

Figure 2. Cross section through R1-R8 with new vein discoveries (1000m section width; looking east)

Fifteen drill holes completed during the 2023 winter drill program were designed to infill along the R1 trend while targeting deeper mineralisation to the south. Highlights along the R1 trend include hole 23RDD163 which returned 15.00m at 14.88 g/t Au incl. 1.10m at 37.04 g/t Au and incl. 2.00m at 57.15 g/t Au, located 50m down-dip from 21RDD024 (5.72m at 90.56 g/t Au*). Drill holes targeting a large gap in drilling at depth along the R1 and R5 trends includes 23RDD167 which returned 3.43m at 43.23 g/t Au incl. 0.44m at 174.30 g/t Au, and 3.15m at 138.74 g/t Au incl. 0.40m at 476.40 g/t Au, approximately 70m to the west of 22RDD143 (1.83m at 18.09 g/t Au, and 2.31m at 8.97 g/t Au incl. 0.44m at 32.40 g/t Au**).

To the south of the R1 trend, drilling has successfully intersected mineralisation linking the R2-R3 (west) and R5-R6-R7-R8 (east) structural corridor, demonstrating a known strike length of 1,800m. Drill holes completed within this gap zone include 23RDD159 which returned 9.62m at 4.22 g/t Au incl. 0.40m at 57.60 g/t Au, located 230m west of hole 23RDD162 which returned 7.10m at 12.24 g/t Au incl. 1.70m at 45.14 g/t Au.

Drill holes 23RDD159, 23RDD162 and 23RDD172 were designed to explore for additional sub-parallel veins at depth towards the south of known mineralised structures. Hole 23RDD159 intersected several newly discovered mineralised structures including 4.75m at 5.97 g/t Au incl. 0.50m at 46.70 g/t Au, and 1.20m at 55.70 g/t Au. Drill hole 23RDD162 also intersected several new mineralised structures, approximately 275m to the east of 23RDD159, including 17.57m at 1.45 g/t Au, 6.25m at 2.29 g/t Au, and 2.01m at 5.25 g/t Au, confirming the significance of these newly discovered mineralised structures. Assay results from hole 23RDD172 remain pending. Geologic and vein models will be updated once all assays have been received from the 2023 winter drill campaign.

(* See press release May 26, 2021)

(** See press release November 14, 2022)

Table 1. Table of partial results from the 2023 winter drill program

| HOLE ID |

|

From (m) |

To (m) |

Interval (m)† |

Au (g/t) |

Ag (g/t) |

Residual Au (g/t)‡ |

| 23RDD159 |

|

307.52 |

317.14 |

9.62 |

4.22 |

3.53 |

1.90 |

| Incl. |

315.78 |

316.18 |

0.40 |

57.60 |

56.70 |

|

| And |

615.00 |

621.00 |

6.00 |

0.96 |

1.08 |

|

| And |

813.00 |

826.50 |

13.50 |

0.77 |

0.98 |

|

| And |

870.00 |

871.50 |

1.50 |

11.50 |

5.10 |

|

| And |

1034.10 |

1038.85 |

4.75 |

5.97 |

5.90 |

1.17 |

| Incl. |

1036.55 |

1037.05 |

0.50 |

46.70 |

43.80 |

|

| And |

1057.30 |

1066.50 |

9.20 |

0.62 |

0.81 |

|

| And |

1179.60 |

1180.80 |

1.20 |

55.70 |

51.23 |

|

| 23RDD160 |

|

149.00 |

159.20 |

10.20 |

4.12 |

3.04 |

1.65 |

| Incl. |

156.46 |

157.60 |

1.14 |

23.75 |

14.27 |

|

| And |

285.00 |

287.55 |

2.55 |

4.05 |

2.87 |

1.33 |

| Incl. |

286.93 |

287.55 |

0.62 |

12.50 |

7.60 |

|

| And |

311.00 |

313.00 |

2.00 |

4.54 |

2.10 |

|

| And |

347.56 |

351.60 |

4.04 |

4.65 |

6.89 |

1.19 |

| Incl. |

348.50 |

349.00 |

0.50 |

29.10 |

46.40 |

|

| And |

427.15 |

445.40 |

18.25 |

0.59 |

0.51 |

|

| And |

452.31 |

456.75 |

4.44 |

5.13 |

7.09 |

1.12 |

| Incl. |

452.85 |

453.15 |

0.30 |

60.50 |

89.50 |

|

| And |

464.00 |

469.70 |

5.70 |

3.21 |

2.74 |

2.00 |

| Incl. |

467.26 |

468.46 |

1.20 |

7.73 |

5.41 |

|

| And |

543.60 |

548.50 |

4.90 |

1.89 |

0.33 |

1.28 |

| Incl. |

546.00 |

547.00 |

1.00 |

4.28 |

0.80 |

|

| And |

624.79 |

628.30 |

3.51 |

7.88 |

10.23 |

1.94 |

| Incl. |

624.79 |

625.15 |

0.36 |

59.90 |

90.40 |

|

| And |

696.50 |

702.00 |

5.50 |

5.26 |

3.52 |

1.64 |

| Incl. |

700.90 |

701.50 |

0.60 |

34.80 |

25.70 |

|

| And |

716.60 |

719.10 |

2.50 |

17.83 |

6.35 |

3.21 |

| Incl. |

718.30 |

719.10 |

0.80 |

48.90 |

15.90 |

|

| And |

782.30 |

793.90 |

11.60 |

0.99 |

0.94 |

|

| And |

876.00 |

881.80 |

5.80 |

1.40 |

1.12 |

|

| 23RDD161 |

|

34.95 |

45.50 |

10.55 |

0.53 |

0.57 |

|

| And |

358.30 |

359.70 |

1.40 |

7.81 |

8.09 |

1.76 |

| Incl. |

358.90 |

359.40 |

0.50 |

18.70 |

20.30 |

|

| And |

478.70 |

479.30 |

0.60 |

59.40 |

68.10 |

|

| And |

500.20 |

514.55 |

14.35 |

1.97 |

2.55 |

1.03 |

| Incl. |

502.40 |

504.12 |

1.72 |

8.83 |

11.91 |

|

| 23RDD162 |

|

357.50 |

364.60 |

7.10 |

12.24 |

6.87 |

1.88 |

| Incl. |

360.45 |

362.15 |

1.70 |

45.14 |

25.22 |

|

| And |

514.70 |

517.40 |

2.70 |

2.34 |

1.90 |

|

| And |

545.80 |

546.80 |

1.00 |

7.18 |

5.60 |

|

| And |

592.20 |

594.75 |

2.55 |

2.06 |

2.10 |

|

| And |

664.50 |

682.07 |

17.57 |

1.45 |

1.59 |

1.20 |

| Incl. |

672.87 |

675.00 |

2.13 |

3.22 |

4.06 |

|

| And |

1018.50 |

1029.55 |

11.05 |

1.30 |

1.10 |

|

| And |

1040.75 |

1047.00 |

6.25 |

2.29 |

1.56 |

1.19 |

| Incl. |

1043.20 |

1044.20 |

1.00 |

8.09 |

4.70 |

|

| And |

1054.00 |

1068.00 |

14.00 |

0.84 |

0.66 |

|

| And |

1075.50 |

1081.50 |

6.00 |

1.41 |

1.13 |

|

| And |

1107.46 |

1109.47 |

2.01 |

5.25 |

5.49 |

|

| 23RDD163 |

|

125.40 |

140.40 |

15.00 |

14.88 |

13.06 |

5.72 |

| Incl. |

125.90 |

127.00 |

1.10 |

37.04 |

35.88 |

|

| And Incl. |

134.50 |

136.50 |

2.00 |

57.15 |

42.90 |

|

| And |

310.00 |

313.30 |

3.30 |

11.50 |

5.22 |

|

| And |

501.14 |

517.30 |

16.16 |

1.27 |

1.27 |

1.02 |

| Incl. |

504.00 |

505.26 |

1.26 |

4.25 |

1.77 |

|

| And |

675.00 |

679.00 |

4.00 |

1.95 |

1.85 |

1.45 |

| Incl. |

676.00 |

677.00 |

1.00 |

3.46 |

2.60 |

|

| 23RDD164 |

|

177.36 |

179.00 |

1.64 |

19.61 |

6.26 |

1.81 |

| Incl. |

177.36 |

177.74 |

0.38 |

78.60 |

25.80 |

|

| And |

273.30 |

275.00 |

1.70 |

3.47 |

2.09 |

|

| And |

285.12 |

292.00 |

6.88 |

1.33 |

1.16 |

|

| And |

305.00 |

307.00 |

2.00 |

5.07 |

7.43 |

|

| And |

375.70 |

378.40 |

2.70 |

2.73 |

1.67 |

1.78 |

| Incl. |

375.70 |

376.06 |

0.36 |

8.93 |

3.00 |

|

| And |

495.47 |

505.68 |

10.21 |

1.21 |

1.17 |

|

| And |

588.39 |

589.98 |

1.59 |

6.32 |

3.59 |

0.98 |

| Incl. |

589.60 |

589.98 |

0.38 |

23.30 |

13.30 |

|

| And |

600.66 |

603.26 |

2.60 |

16.43 |

9.17 |

3.46 |

| Incl. |

600.66 |

601.10 |

0.44 |

80.10 |

43.40 |

|

| And |

756.00 |

762.00 |

6.00 |

0.90 |

0.82 |

|

| And |

793.78 |

798.80 |

5.02 |

1.20 |

0.85 |

|

| And |

922.50 |

926.00 |

3.50 |

1.54 |

0.94 |

|

| And |

964.73 |

966.00 |

1.27 |

4.30 |

3.56 |

|

| 23RDD167 |

|

77.20 |

78.20 |

1.00 |

5.89 |

1.89 |

|

| And |

157.80 |

162.00 |

4.20 |

1.74 |

1.03 |

|

| And |

176.00 |

181.55 |

5.55 |

1.04 |

1.17 |

|

| And |

194.50 |

199.80 |

5.30 |

4.30 |

4.38 |

2.80 |

| Incl. |

198.80 |

199.25 |

0.45 |

20.40 |

20.00 |

|

| And |

221.40 |

238.00 |

16.60 |

0.77 |

0.92 |

|

| And |

336.50 |

343.30 |

6.80 |

1.15 |

0.60 |

|

| And |

347.05 |

348.20 |

1.15 |

10.60 |

3.69 |

|

| And |

420.20 |

427.00 |

6.80 |

1.14 |

1.34 |

|

| And |

444.27 |

447.70 |

3.43 |

43.23 |

33.05 |

23.94 |

| Incl. |

444.76 |

445.20 |

0.44 |

174.30 |

96.50 |

|

| And |

466.45 |

469.60 |

3.15 |

138.74 |

95.28 |

89.62 |

| Incl. |

466.45 |

466.85 |

0.40 |

476.40 |

129.60 |

|

| And |

495.50 |

497.17 |

1.67 |

3.60 |

1.66 |

1.58 |

| Incl. |

496.00 |

496.35 |

0.35 |

11.20 |

3.80 |

|

| And |

527.61 |

532.73 |

5.12 |

1.06 |

0.52 |

|

† Assay intervals reported are core lengths, true widths have not been determined

‡ Residual Au (g/t) represents the average grade of the drill hole interval excluding the highlighted internal interval

Table 2. Drill collar table of reported drill holes from the 2023 winter drill program

| Hole ID |

Easting (NAD83) |

Northing (NAD83) |

Elevation (m) |

Depth (m) |

Dip |

Azimuth |

| 23RDD159 |

519167 |

5620379 |

375 |

1200.00 |

-58 |

153 |

| 23RDD160 |

519768 |

5621023 |

375 |

990.00 |

-61 |

159 |

| 23RDD161 |

519358 |

5620954 |

375 |

798.00 |

-62 |

159 |

| 23RDD162 |

519360 |

5620482 |

375 |

1164.78 |

-55 |

152 |

| 23RDD163 |

519463 |

5620818 |

375 |

857.50 |

-58 |

160 |

| 23RDD164 |

519632 |

5620965 |

375 |

975.00 |

-61 |

160 |

| 23RDD167 |

519772 |

5621135 |

375 |

696.00 |

-62 |

160 |

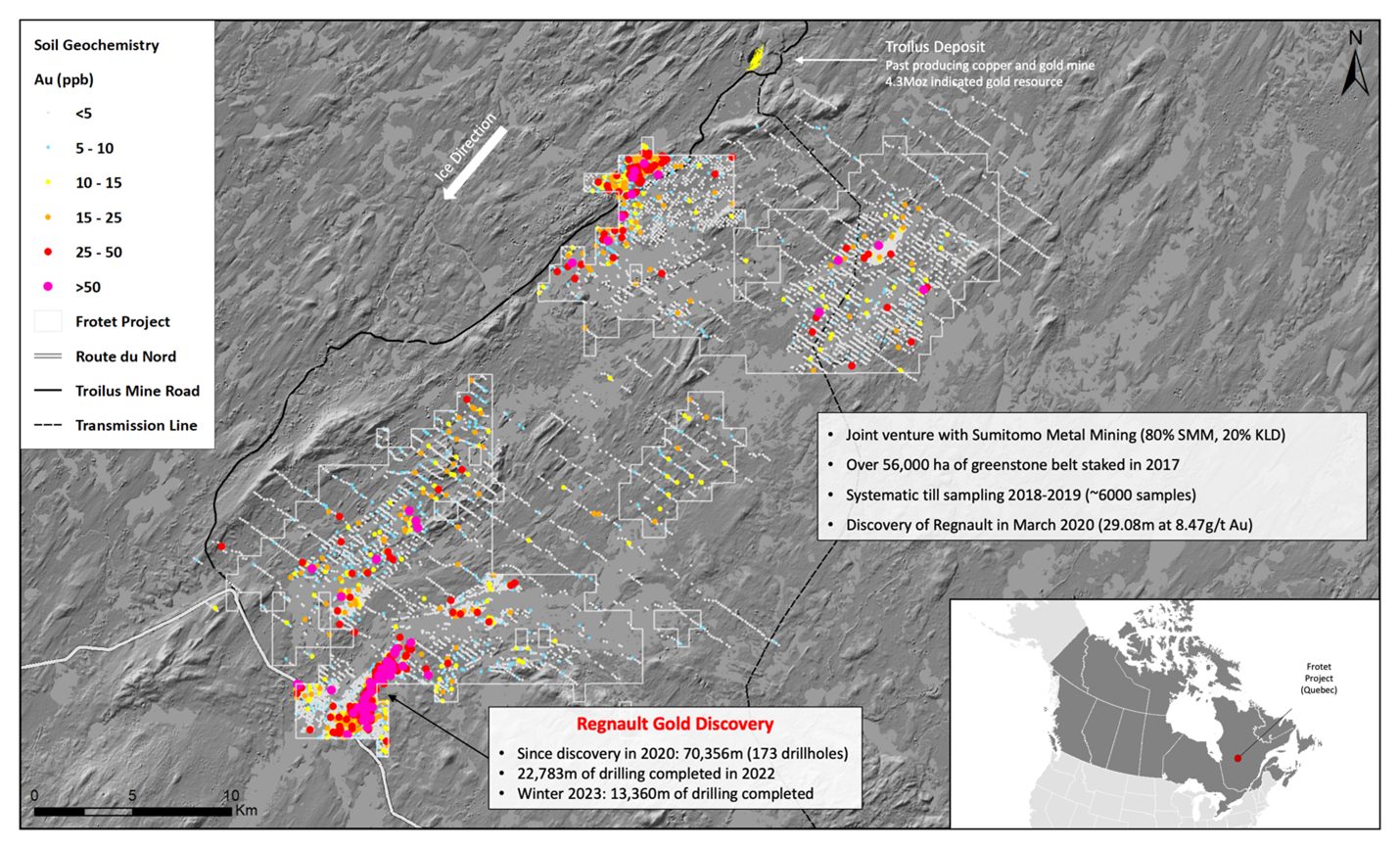

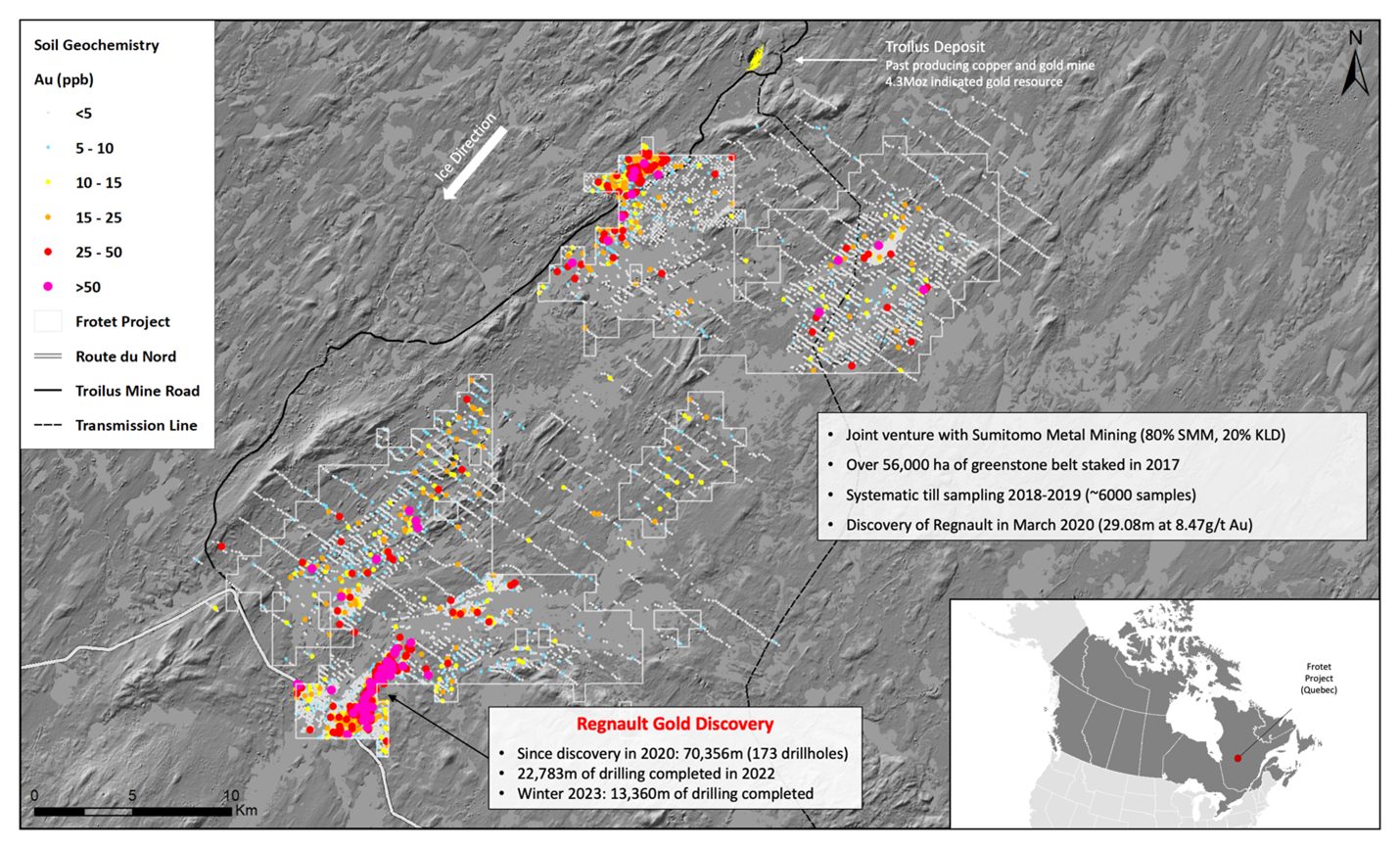

Figure 3. Map of Frotet Project showing regional till sampling geochemical results

Exercise of Top-up Right

The Company announces that further to its press release dated April 19, 2023, the Company and SMMCL, have completed the exercise of SMMCL’s ‘top-up right’ to retain its 10.1% interest in the Company as granted within the investor rights agreement dated November 5, 2021.

An aggregate of 20,006 common shares (the “Shares”) were issued for aggregate consideration of $15,520.14. The Shares are subject to a statutory hold period in accordance with applicable securities legislation and the rules and policies of the TSX Venture Exchange expiring on September 5, 2023.

About the Frotet Project

The Frotet Project was first identified by Kenorland in 2017 after completing a regional prospectivity study over the Abitibi and Frotet-Evans Greenstone Belts of Quebec. The initial 55,921 ha property was acquired through map staking in March 2017 and optioned to Sumitomo Metal Mining Canada Ltd., a wholly owned subsidiary of Sumitomo Metal Mining Co., Ltd. in April 2018. Two years of property-wide systematic till sampling led to a maiden drill program in 2020 which resulted in a significant grassroots discovery at the prospect now named Regnault. The project is currently under the Joint Venture agreement between SMMCL and Kenorland Minerals Ltd., with interests being held at 80% and 20%, respectively. Under the Joint Venture, exploration is funded pro-rata and Kenorland is presently the operator of the project. Any party which does not contribute and is diluted below a 10% interest, converts its interest to an 2% uncapped net smelter royalty.

QA/QC and Core Sampling Protocols

All drill core samples were collected under the supervision of Kenorland employees. Drill core was transported from the drill platform to the logging facility where it was logged, photographed, and split by diamond saw prior to being sampled. Samples were then bagged, and blanks and certified reference materials were inserted at regular intervals. Groups of samples were placed in large bags, sealed with numbered tags in order to maintain a chain-of-custody, and transported from Chibougamau to Bureau Veritas Commodities (“BV”) laboratory in Timmins, Ontario.

Sample preparation and analytical work for this drill program were carried out by BV. Samples were prepared for analysis according to BV method PRP70-250: individual samples were crushed to 2mm (10 mesh) and a 250g split was pulverized to 75μm (200 mesh) for analysis and then assayed for gold. Gold in samples were analyzed using BV method FA430 where a 30g split is analyzed with fire assay by Pb collection and AAS finish. Over-limits gold samples were re-analyzed using BV method FA530 where a 30g split is analyzed with fire assay by Pb collection and gravimetric finish. Multi-element geochemical analysis (45 elements) was performed on all samples using BV method MA200 where a 0.25g split is by multi-acid digest with ICP-MS/ES finish. All results passed the QA/QC screening at the lab, all company inserted standards and blanks returned results that were within acceptable limits.

Qualified Person

Cédric Mayer, M. Sc., P. Geo. (OGQ #02385), is the “Qualified Person” under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

About Kenorland Minerals Ltd.

Kenorland Minerals Ltd. (TSX.V: KLD) is a mineral exploration company incorporated under the laws of the Province of British Columbia and based in Vancouver, British Columbia, Canada. Kenorland’s focus is early to advanced stage exploration in North America. The Company currently holds five projects in Quebec where work is being completed under joint venture and earn-in agreements from third parties. The Frotet Project and Chicobi Project are held under joint venture with Sumitomo, the O’Sullivan Project is optioned to Sumitomo, the Chebistuan Project is optioned to Newmont Corporation and the Hunter Project is held under option to Centerra Gold Inc. In Alaska, the Company holds the advanced stage Tanacross porphyry Cu-Au-Mo project, optioned to Antofagasta, as well as a 70% interest in the Healy Project, held under joint venture with Newmont Corporation.

Further information can be found on the Company’s website www.kenorlandminerals.com

Zach Flood

President, CEO and Director

Tel: +1 604 363 1779

zach@kenorlandminerals.com

Cautionary Statement Regarding Forward Looking Statements

This news release contains forward-looking statements and forward-looking information (together, “forward-looking statements”) within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as “plans”, “expects’, “estimates”, “intends”, “anticipates”, “believes” or variations of such words, or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will be taken”, “occur” or “be achieved”. Forward looking statements involve risks, uncertainties and other factors disclosed under the heading “Risk Factors” and elsewhere in the Company’s filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.