Kenorland Minerals intersects 117.86 g/t Au over 1.77m on R2 and announces additional vein discoveries at Regnault

March 28, 2022

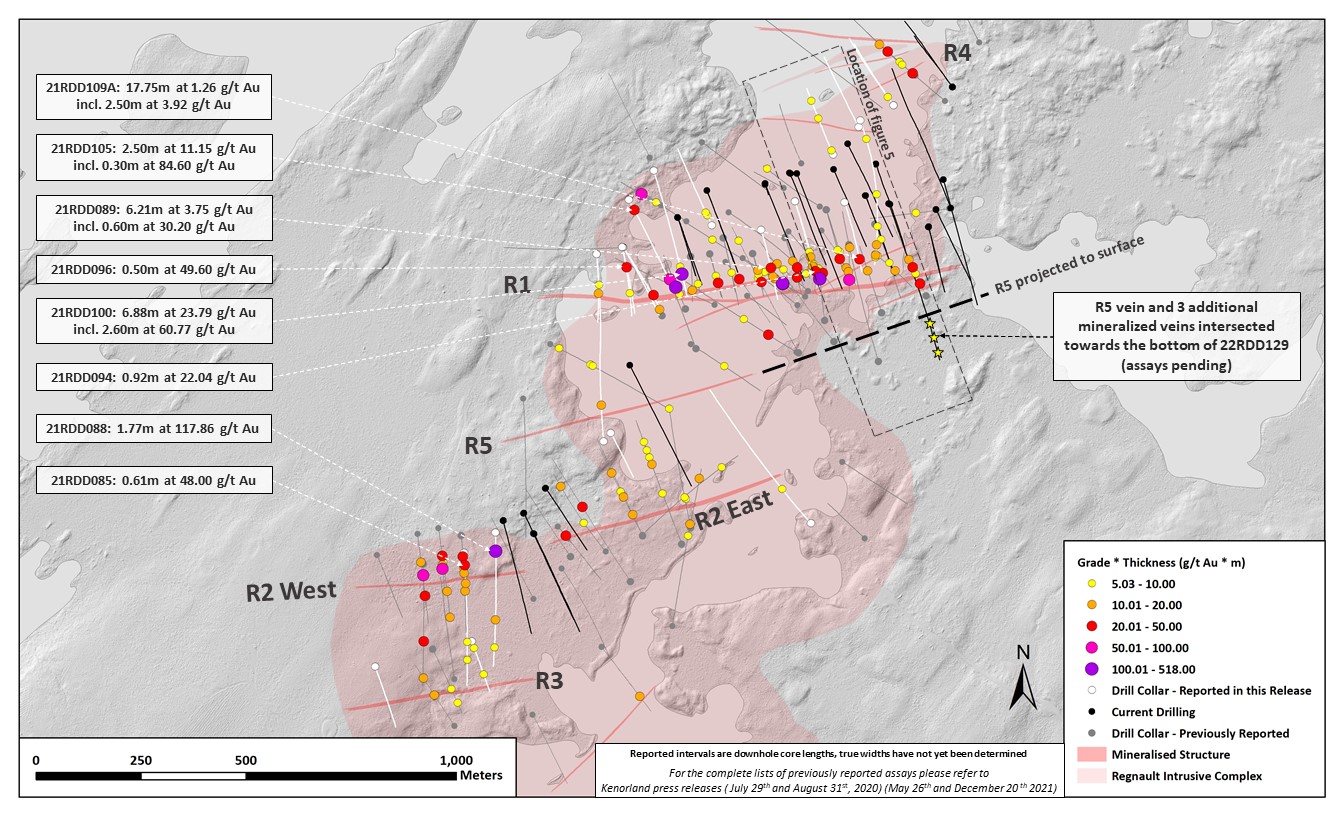

Vancouver, British Columbia, March 28, 2022 – Kenorland Minerals Ltd. (TSXV:KLD)(OTCQX:NWRCF) (FSE:3WQ0) (“Kenorland” or “the Company”) is pleased to announce final drill results from the 2021 summer-fall drill program at the Regnault gold discovery within the Frotet Project (“the Project”), located in northern Quebec and held under joint venture (“the Joint Venture”) with Sumitomo Metal Mining Canada Ltd. (“SMMCL”). Assays from the remaining 25 of 57 drill holes completed, including 7,968 meters of the 17,792 meter program, are reported herein. The Company also provides an update on the recently completed winter drill program, including the announcement of additional vein discoveries at Regnault.

Highlights include the following:

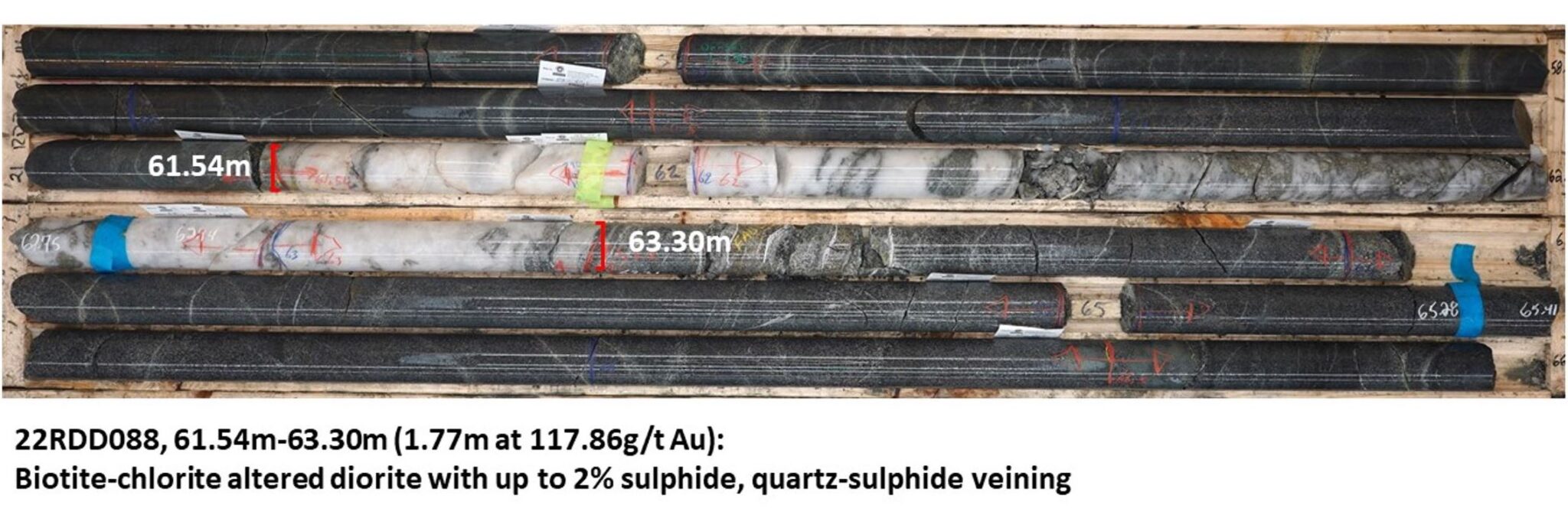

- 21RDD088: 1.77m at 117.86 g/t Au at R2 West

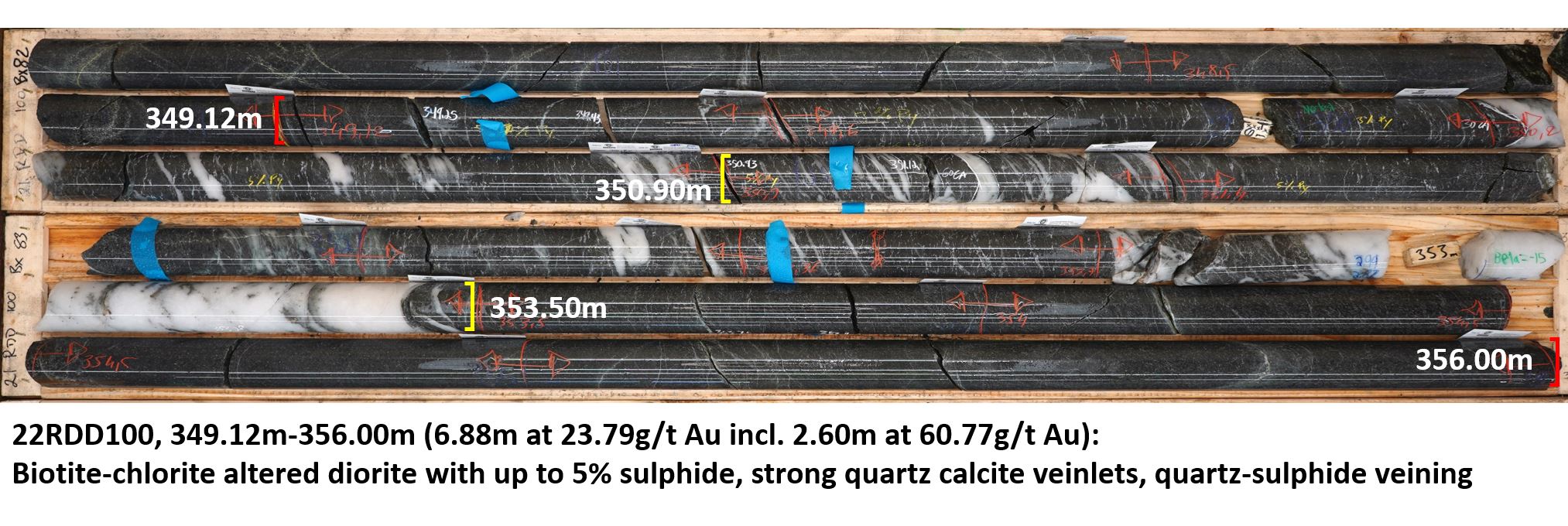

- 21RDD100: 6.88m at 23.79 g/t Au incl. 2.60m at 60.77 g/t Au at R1

- 21RDD085: 0.61m at 48.00 g/t Au at R2 West

- 21RDD105: 2.50m at 11.15 g/t Au incl. 0.30m at 84.60 g/t Au at R1

- 21RDD094: 0.92m at 22.04 g/t Au at R1

- Discovery of the R5 Vein and three additional vein structures to the south of R1 during the current 2022 winter drill campaign (assays pending)

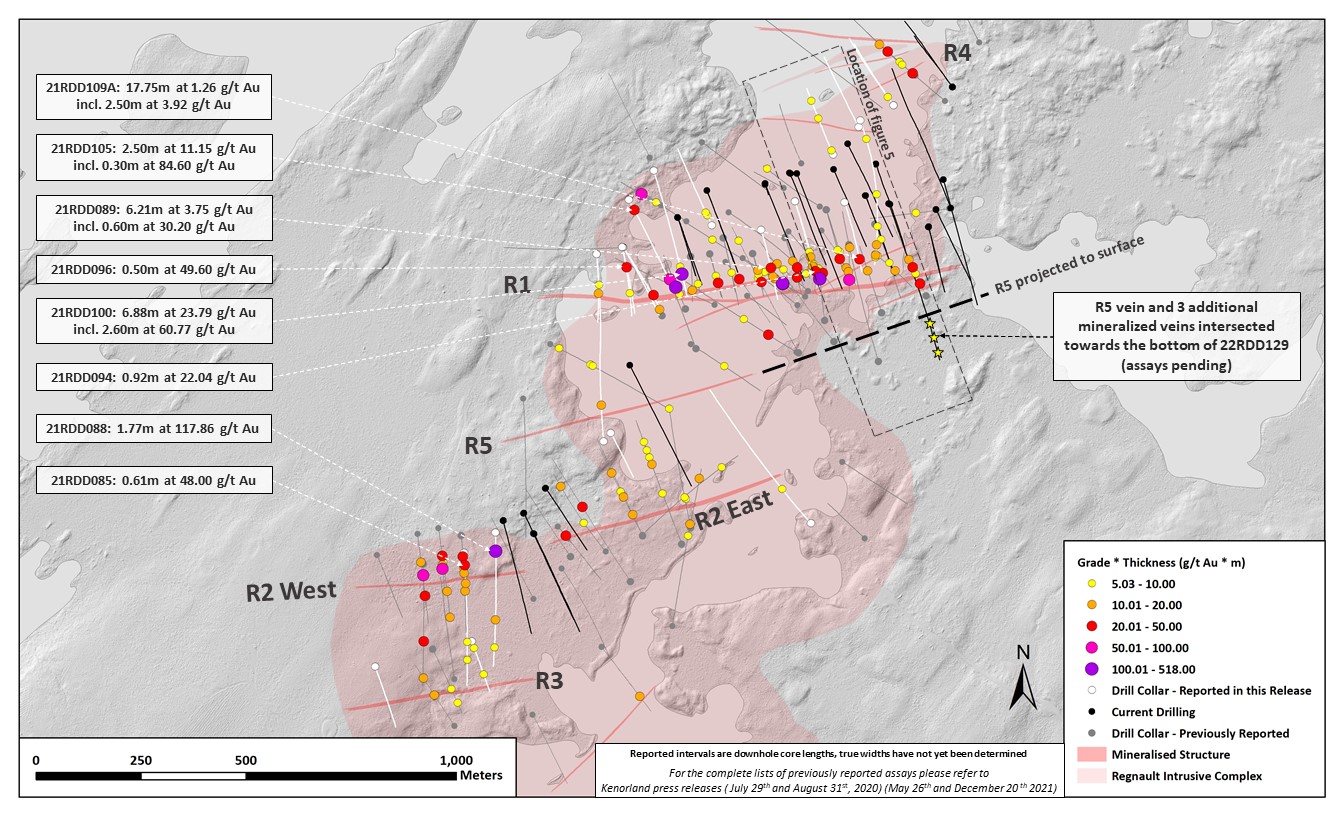

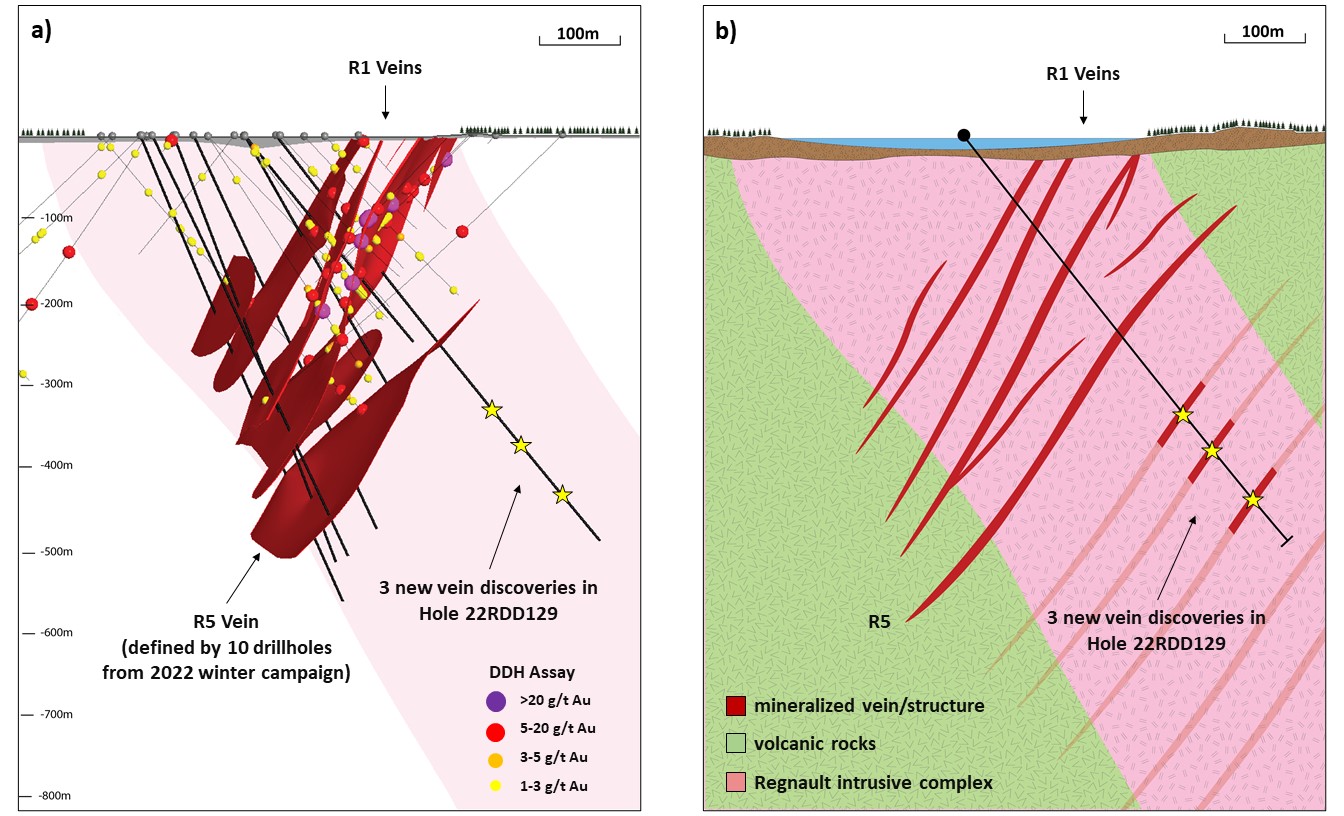

Figure 1. Plan map of Regnault drilling highlights

Zach Flood, CEO of Kenorland Minerals states, “The last remaining results from the 2021 drill program continue to demonstrate the exceptional high-grade nature of the Regnault gold system, including the most significant intercept at R2 to date. We have also completed the 2022 winter drill program which concludes the fiscal 2021 budget cycle. On this program we pushed drilling southward well beyond the R1 veins and intersected a series of additional parallel shear veins at depth. The significance of this development cannot be understated as it confirms the potential for additional vein discoveries within the intrusive complex. We anticipate the 2022 fiscal budget to be finalised towards the end of the month and we look forward to continuing our advancement of this remarkable gold discovery.”

Discussion of Results

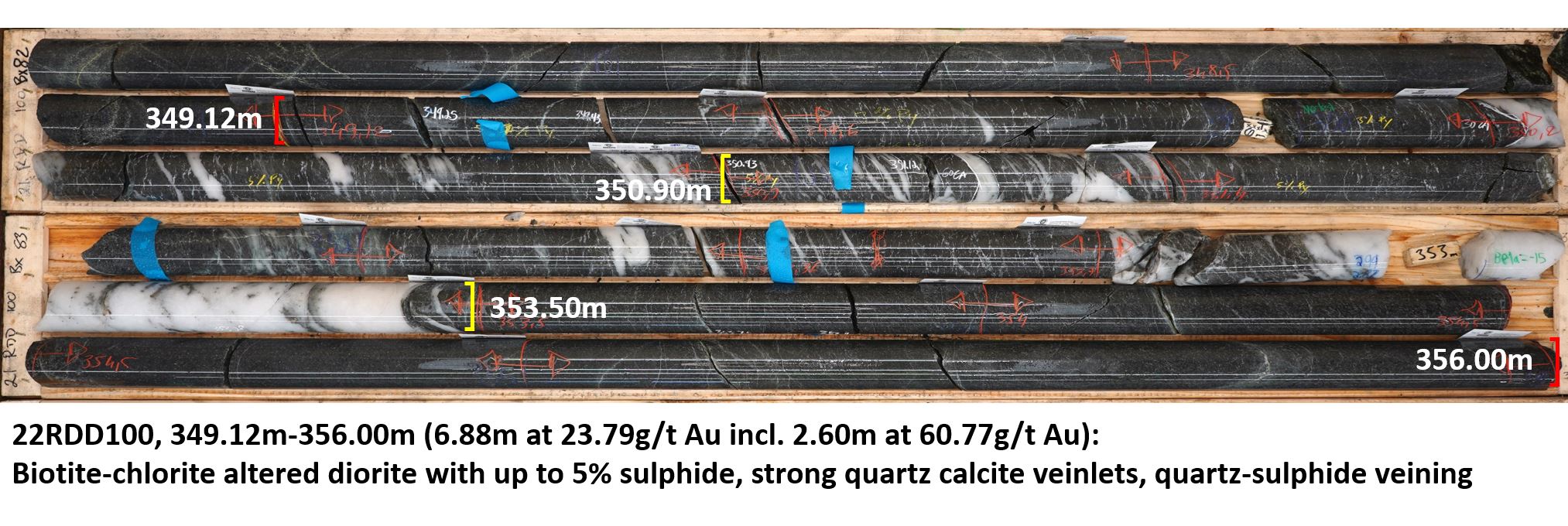

The reported 25 drillholes (7,968m) follow the previously reported 32 drillholes of the 2021 summer-fall drill program completed in October 2021*. The drill program was designed to systematically test along strike and down-dip extents of the R1, R2 East and R2 West mineralised structures at Regnault. Along the R1 trend, highlights included hole 21RDD100 which stepped 80m down-dip from 21RDD074 (3.45m at 17.53g/t Au*) and intersected 6.88m at 23.79g/t Au including 2.60m at 60.77g/t Au. Hole 21RDD089 stepped 60m down-dip from 21RDD024 (5.72m at 90.56g/t Au**) and intersected 6.21m at 3.75g/t Au incl. 0.60m at 30.20g/t Au. Drillhole 21RDD094 stepped 80m down-dip from 21RDD056A (15.4m at 17.96g/t Au*) and intersected 0.92m at 22.04g/t Au. Hole 21RDD109A stepped 75m down-dip of 21RDD032 (4.87m at 3.80g/t Au**) and intersected 17.75m at 1.26g/t Au including 2.50m at 3.92g/t Au. Drillhole 21RDD105 returned 2.5m at 11.15g/t Au including 0.30m at 84.60g/t Au near the top of the hole along a separate structure 200m north of R1 and 50m along strike from 20RDD021A (2.66m at 33.69g/t Au***). These results extend the known mineralisation along R1 to depths of 330m below surface and 750m along strike, remaining open to depth and along strike.

( * See press release dated December 20th 2021, ** See press release dated May 6th 2021, *** See press release dated August 31st 2020 )

Figure 2. Core photo of 21RDD100 from R1 zone: 6.88m at 23.79 g/t Au incl. 2.60m at 60.77 g/t Au

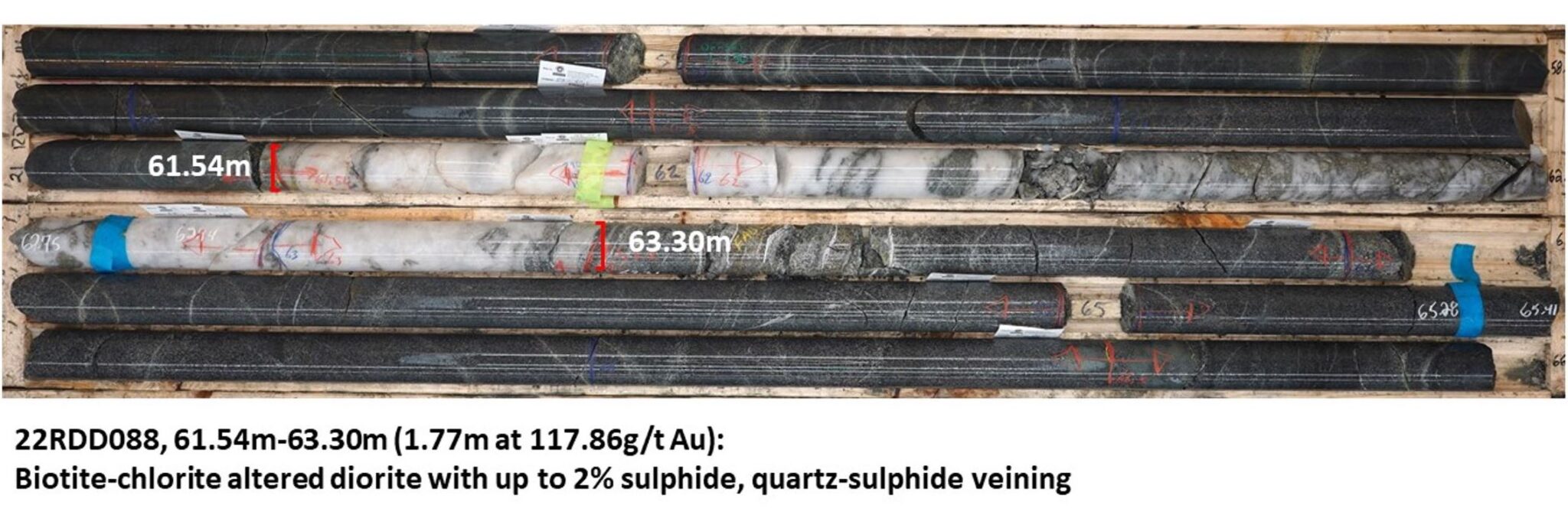

Gold mineralisation along the R1 trend is associated with multiple east-west trending and north-dipping shear zones. Mineralised structures transect both the multiphase Regnault intrusive complex and surrounding volcanic rocks and are defined by zones of moderate-strong strain, biotite-calcite ± silica-chlorite alteration and disseminated pyrite (locally ranging from 3-10%). High grade intercepts are characteristically shear-hosted, laminated quartz-carbonate-pyrite veins, often haloed by variably deformed extensional stockwork quartz veining locally containing up to 20% pyrite along with trace chalcopyrite, Au ± Ag tellurides and visible gold.

Along the R2 trend, at R2 West, drillhole 21RDD088 returned 1.77m at 117.86g/t Au intersecting shear-related, vein-hosted mineralisation 80m to the east of 21RDD082A (1.60m at 28.34g/t Au*), representing the highest grade x thickness intercept along R2 to date. Hole 21RDD085 returned 0.61m at 48g/t Au 30m up-dip of 21RDD082A. Known mineralisation along the R2 trend extends over 950m of strike length with multiple veins trending east-northeast and to depths of 350m below surface. Veins include stacked, shallow north dipping extensional type quartz veins (dominant style for R2 West), and E-W trending, steeply north-dipping shear hosted quartz-carbonate veins (the dominant style of mineralisation for R2 East and similar to the R1 Trend) The R2 trend also remains open along strike and to depth.

Figure 3. Core photo of 21RDD088 from R2 zone: 1.77m at 117.86 g/t Au

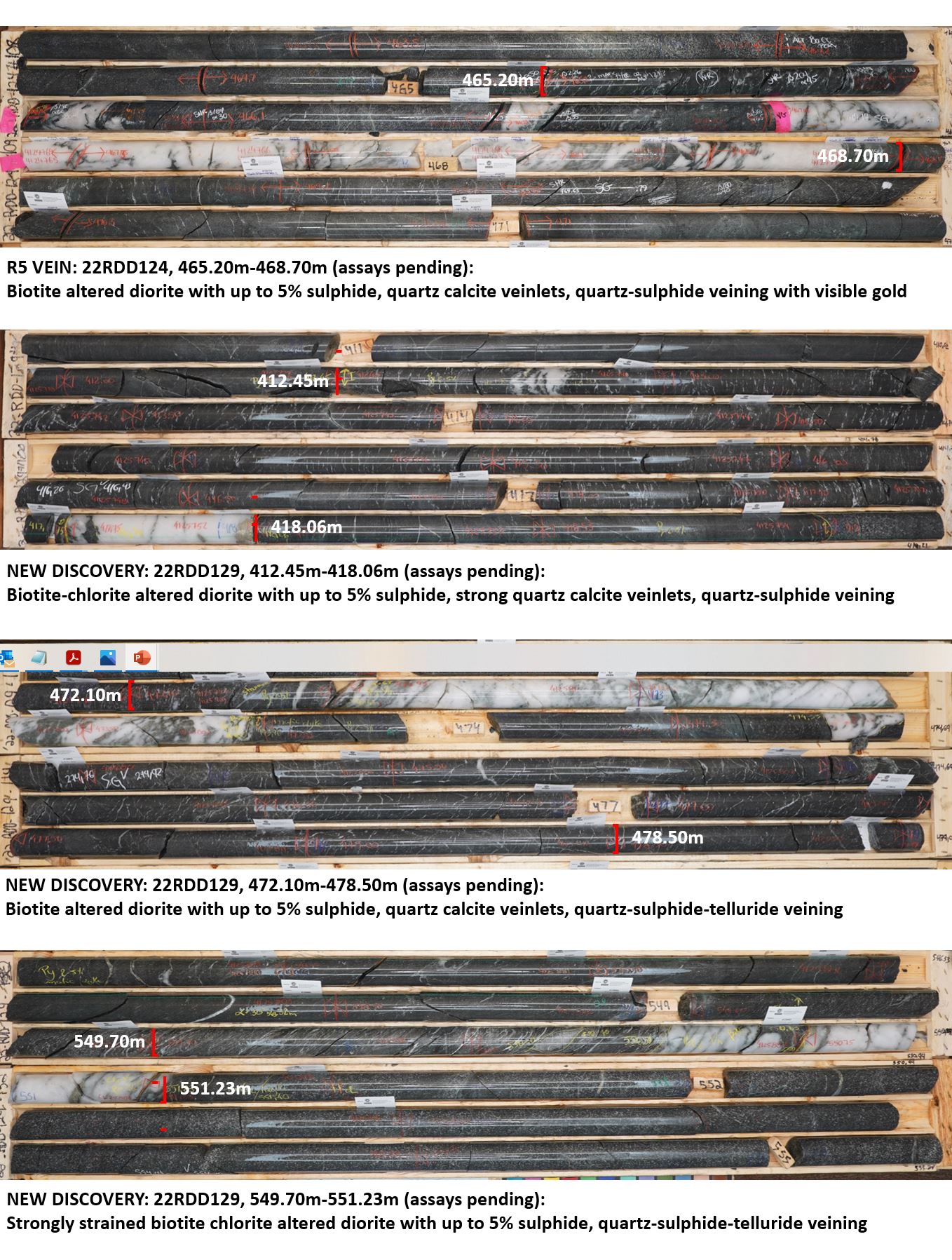

New Discoveries

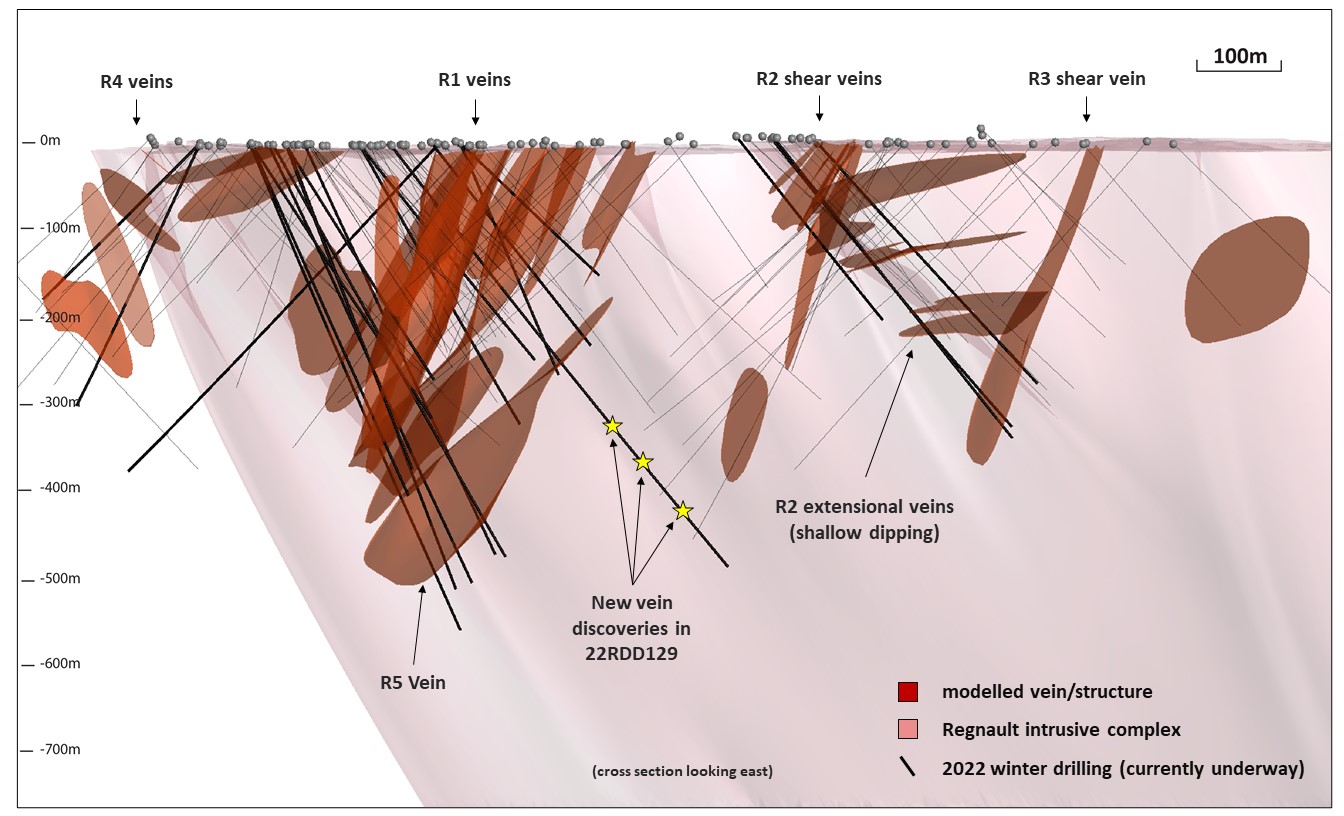

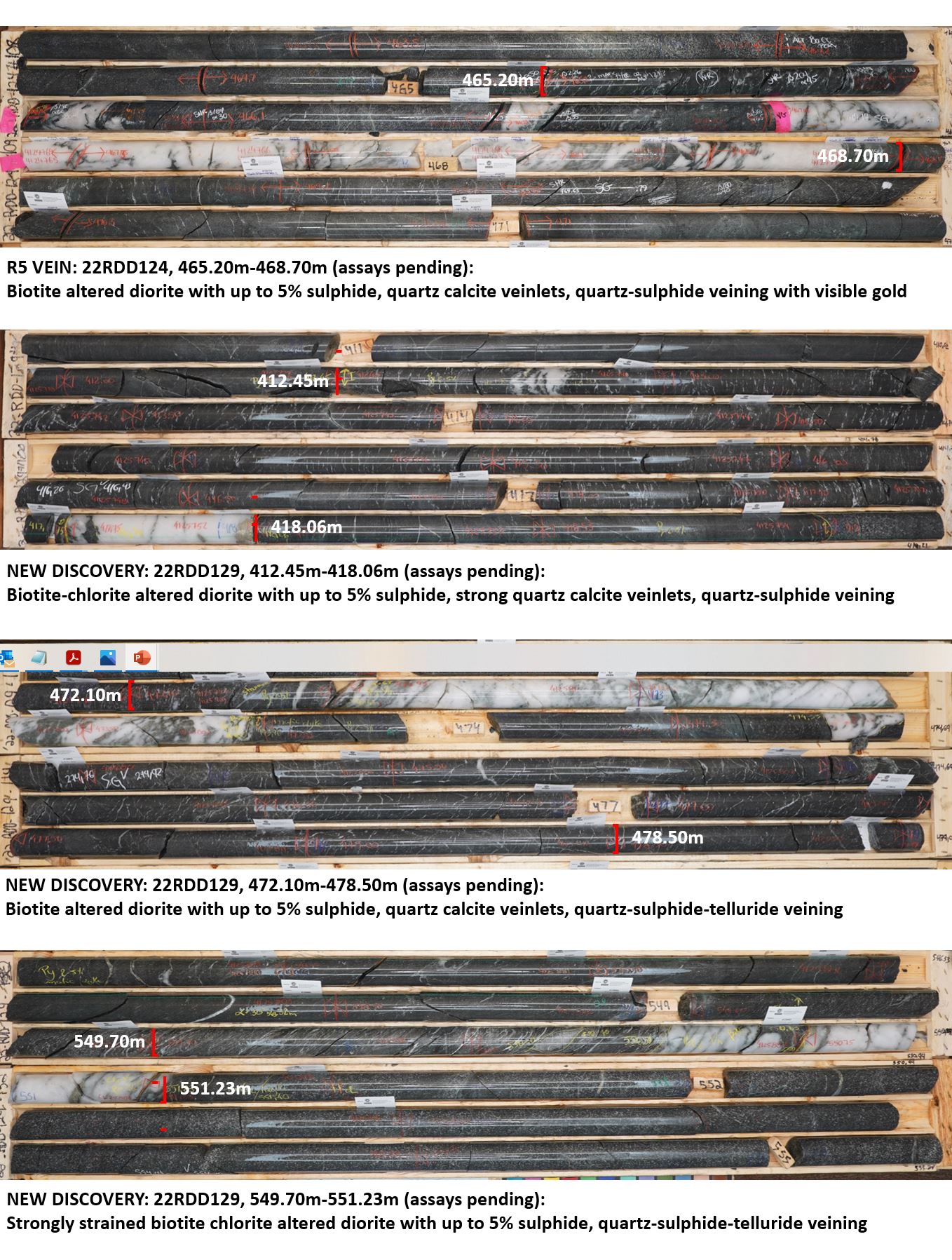

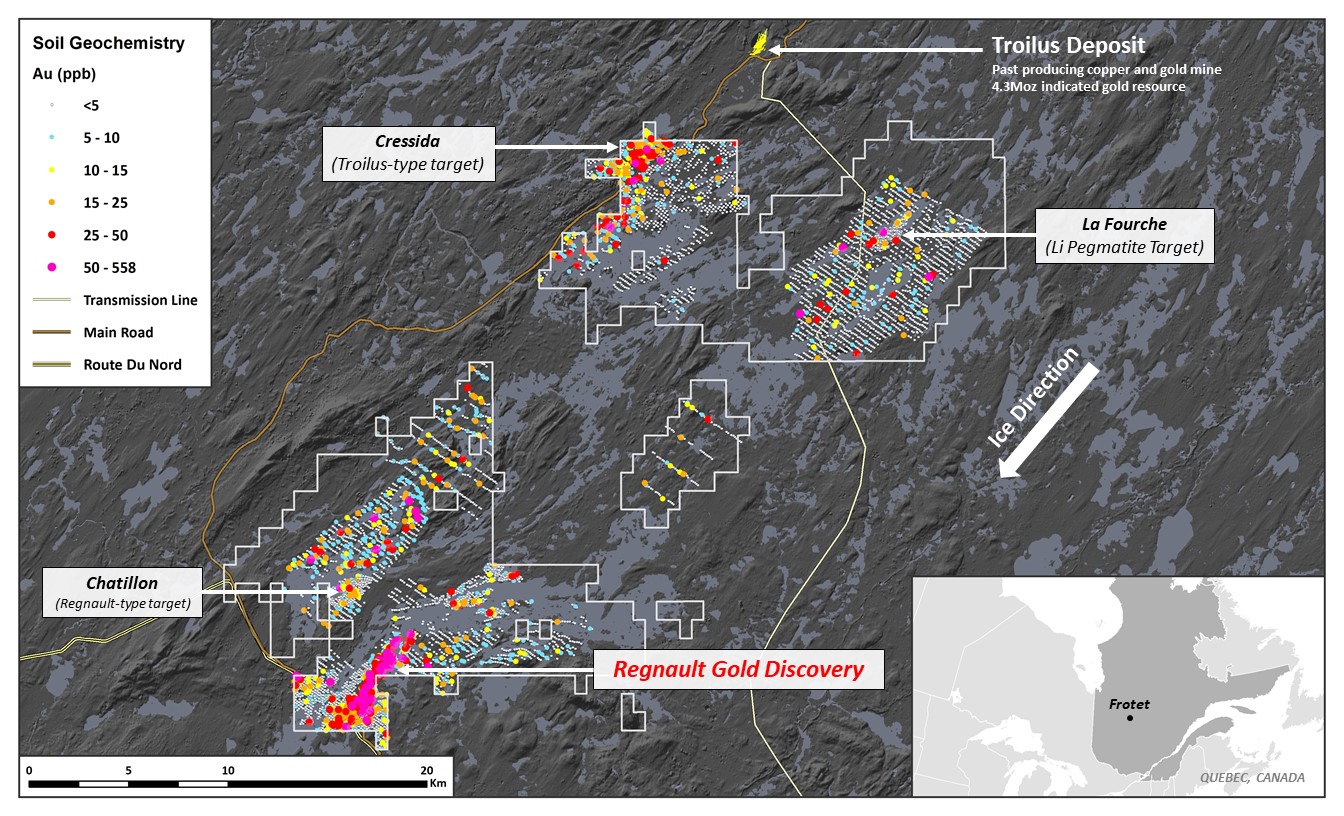

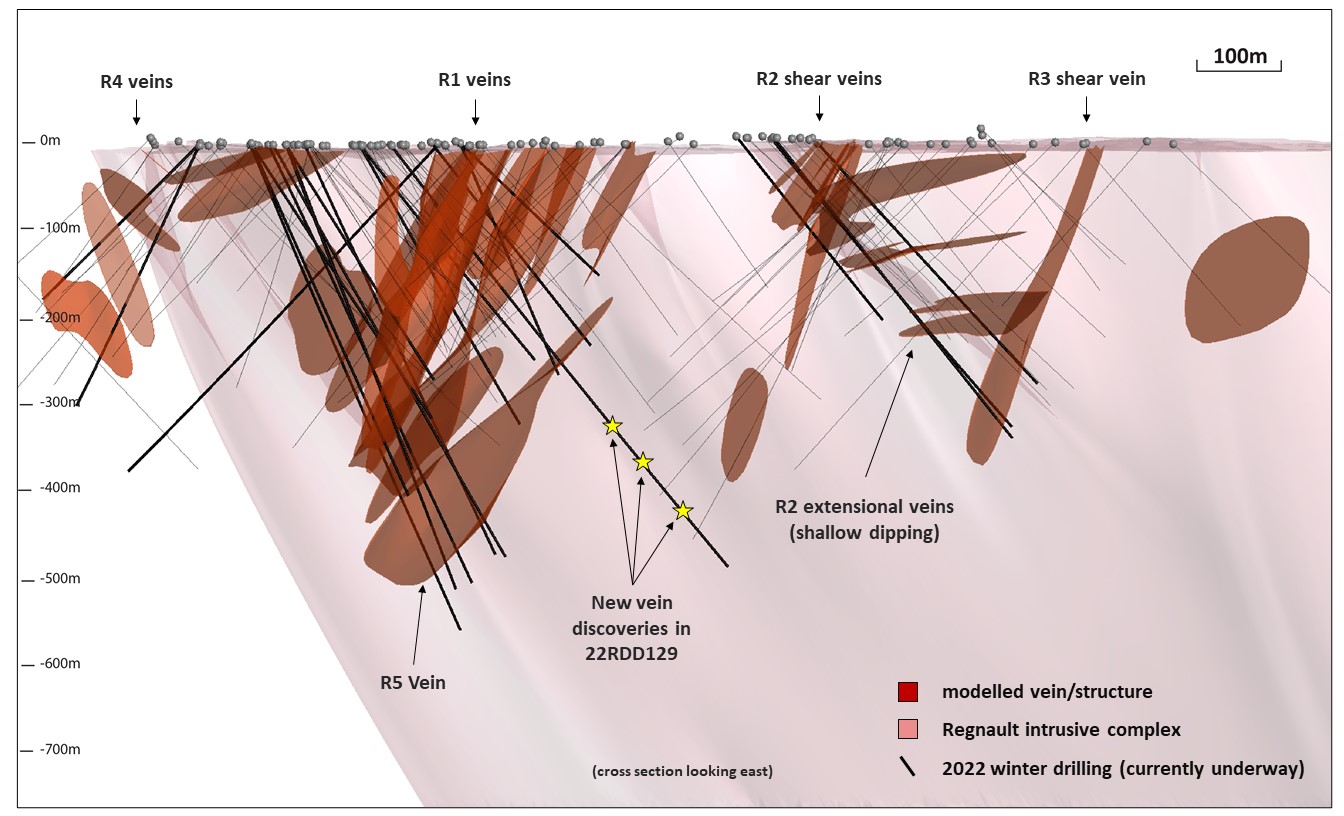

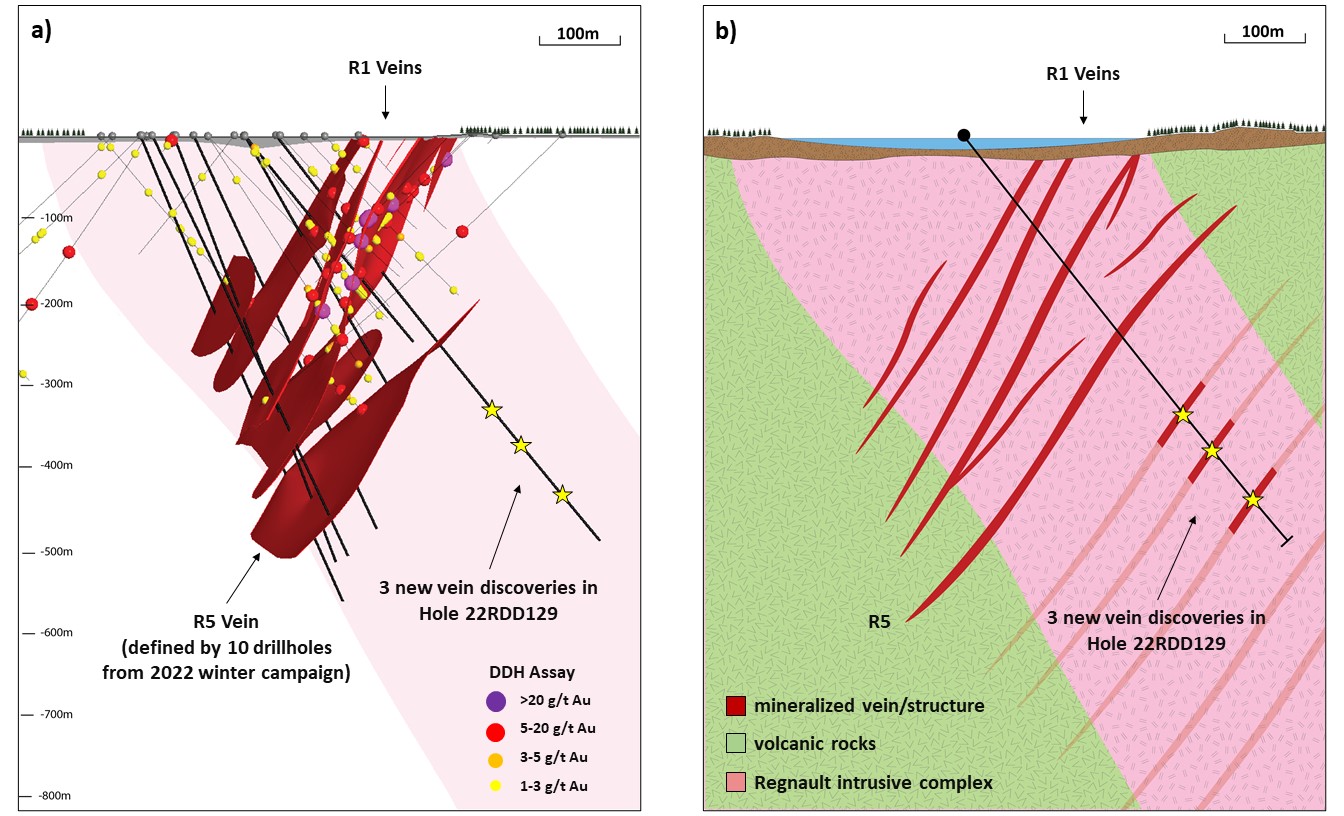

A winter drilling program has recently concluded which explored for additional mineralised structures at depth within Regnault gold system. Visual indications of shear-related mineralisation including quartz-sulphide veining, biotite-calcite alteration and disseminated pyrite, along with locally visible gold and tellurides continue to be intercepted at depth beyond the previous limits of drilling along R1. Of significance is the definition of the R5 structure, which is located directly to the south and parallel to the R1 veins. The R5 structure is presently defined by 10 drillholes along 350m of strike and is open in all directions. In addition to the discovery of R5, 22DDH129, which was drilled to a depth of 624m, and 300m beyond the R5 structure encountered three additional shear-related and mineralised veins. Vein and mineralised envelopes range in thickness from less than a meter up to 5m. The observation of visible mineralisation in the core is a positive sign but is not necessarily indicative that assay results with significant gold mineralisation will be received.

The discovery of these additional structures has advanced the understanding of the Regnault system and resulted in a revised interpretation of a stacked set of mineralised vein/alteration corridors localised within and around the multiphase Regnault intrusive complex (Figure 5). This development in targeting has greatly increased the potential for the discovery of additional vein/alteration zones beyond the currently defined extents of the mineralised system.

Figure 4. Cross section of the entire Regnault system showing modelled vein zones (looking east)

Figure 5. a) Cross section through R1, R5, new vein discoveries (250m section thickness; looking east), and b) schematic geologic model

Figure 6. Core photos of newly intersected veins in 22RDD129 and 22RDD124 (assays pending)

Scott Smits, Vice President of Exploration states, “The summer-fall 2021 drill campaign was a great success, extending the known mineralisation to depth and consistently returning high-grade gold, demonstrating the continuity along the R1 and R2 trends. Ongoing geologic modelling of the Regnault gold system has also greatly increased our understanding of the structural controls and has refined our exploration model, proven by the definition of the R5 vein at depth and discovery of additional veins during the 2022 winter drill program.”

Prior to the announcement of the company’s winter 2022 drill program (see press release dated January 12, 2022) a total of 34,206m had been drilled at Regnault including the initial discovery drill program in early 2020. The recently completed program, included 10,880 meters of drilling between 25 drill holes concludes the fiscal 2021 budget approved by the Joint Venture in May 2021. The project is currently operated by Kenorland Minerals Ltd. and exploration is co-funded with joint venture partner, Sumitomo Metal Mining Canada Ltd.

Figure 7. Complete table of results from the 2021 summer-fall drill program

| Hole ID |

|

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

Residual

Au (g/t) |

| 21RDD081 |

|

141.50 |

150.50 |

9.00 |

0.77 |

0.71 |

|

| 21RDD085 |

|

40.22 |

40.83 |

0.61 |

48.00 |

68.90 |

|

| And |

100.09 |

100.84 |

0.75 |

23.36 |

28.86 |

|

| And |

290.00 |

291.50 |

1.50 |

5.11 |

4.20 |

|

| And |

347.75 |

348.52 |

0.77 |

12.11 |

13.90 |

|

| 21RDD088 |

|

61.54 |

63.31 |

1.77 |

117.86 |

210.49 |

|

| And |

68.70 |

73.00 |

4.30 |

1.02 |

1.08 |

0.72 |

| Incl. |

68.70 |

69.00 |

0.30 |

5.03 |

5.30 |

|

| And |

292.00 |

294.00 |

2.00 |

8.63 |

14.95 |

2.41 |

| Incl. |

292.31 |

292.93 |

0.62 |

22.50 |

38.30 |

|

| And |

383.00 |

384.95 |

1.95 |

3.43 |

3.77 |

0.82 |

| Incl. |

383.79 |

384.95 |

1.16 |

5.21 |

5.60 |

|

| 21RDD089 |

|

27.00 |

30.50 |

3.50 |

1.19 |

0.72 |

0.85 |

| Incl. |

28.00 |

28.40 |

0.40 |

3.81 |

2.80 |

|

| And |

140.00 |

146.21 |

6.21 |

3.75 |

4.56 |

0.92 |

| Incl. |

141.80 |

142.40 |

0.60 |

30.20 |

37.70 |

|

| And |

172.70 |

176.90 |

4.20 |

2.49 |

1.62 |

0.91 |

| Incl. |

175.60 |

176.90 |

1.30 |

6.03 |

3.43 |

|

| 21RDD090 |

|

35.44 |

41.00 |

5.56 |

1.36 |

0.83 |

|

| And |

48.00 |

51.00 |

3.00 |

2.68 |

1.38 |

2.38 |

| Incl. |

50.00 |

50.50 |

0.50 |

4.19 |

2.50 |

|

| And |

88.04 |

92.00 |

3.96 |

1.05 |

1.21 |

|

| 21RDD091A |

|

|

No significant intervals |

|

|

|

|

| 21RDD092 |

|

179.00 |

180.50 |

1.50 |

2.86 |

4.50 |

|

| 21RDD093 |

|

|

No significant intervals |

|

|

|

|

| 21RDD094 |

|

219.73 |

221.50 |

1.77 |

4.58 |

1.81 |

1.18 |

| Incl. |

220.34 |

221.00 |

0.66 |

10.30 |

3.90 |

|

| And |

247.08 |

248.00 |

0.92 |

22.04 |

15.23 |

|

| 21RDD095 |

|

27.84 |

29.00 |

1.16 |

8.02 |

9.30 |

2.11 |

| Incl. |

28.15 |

28.50 |

0.35 |

21.70 |

26.40 |

|

| And |

138.87 |

141.40 |

2.53 |

3.75 |

8.30 |

1.91 |

| Incl. |

138.87 |

139.18 |

0.31 |

16.90 |

20.80 |

|

| 21RDD096 |

|

69.75 |

70.25 |

0.50 |

49.60 |

55.10 |

|

| 21RDD097 |

|

|

Hole abandoned |

|

| 21RDD098 |

|

229.00 |

229.50 |

0.50 |

11.80 |

19.70 |

|

| And |

251.47 |

251.80 |

0.33 |

30.60 |

13.10 |

|

| And |

277.00 |

280.44 |

3.44 |

2.28 |

1.40 |

|

| And |

289.00 |

295.50 |

6.50 |

2.90 |

3.26 |

1.10 |

| Incl. |

293.00 |

294.00 |

1.00 |

12.80 |

16.50 |

|

| 21RDD099 |

|

199.50 |

200.10 |

0.60 |

16.50 |

18.60 |

|

| 21RDD100 |

|

88.60 |

89.20 |

0.60 |

7.74 |

4.15 |

|

| And |

327.00 |

329.00 |

2.00 |

3.11 |

3.17 |

1.68 |

| Incl. |

327.00 |

327.30 |

0.30 |

11.20 |

18.10 |

|

| And |

349.12 |

356.00 |

6.88 |

23.79 |

15.63 |

1.33 |

| Incl. |

350.90 |

353.50 |

2.60 |

60.77 |

38.43 |

|

| 21RDD101 |

|

99.60 |

106.50 |

6.90 |

0.76 |

1.53 |

0.64 |

| Incl. |

101.50 |

101.80 |

0.30 |

3.42 |

7.80 |

|

| And |

126.90 |

130.10 |

3.20 |

1.39 |

1.76 |

1.06 |

| Incl. |

129.40 |

129.70 |

0.30 |

4.57 |

4.30 |

|

| 21RDD102 |

|

245.00 |

247.60 |

2.60 |

1.59 |

0.85 |

1.02 |

| Incl. |

247.30 |

247.60 |

0.30 |

5.93 |

4.20 |

|

| 21RDD103 |

|

168.30 |

171.50 |

3.20 |

5.33 |

5.78 |

2.09 |

| Incl. |

170.15 |

171.50 |

1.35 |

9.77 |

10.40 |

|

| 21RDD104 |

|

46.00 |

49.70 |

3.70 |

2.12 |

0.89 |

|

| 21RDD105 |

|

39.50 |

42.00 |

2.50 |

11.15 |

5.78 |

1.13 |

| Incl. |

39.50 |

39.80 |

0.30 |

84.60 |

42.10 |

|

| And |

305.90 |

311.85 |

5.95 |

1.25 |

1.27 |

1.10 |

| Incl. |

307.30 |

307.60 |

0.30 |

4.12 |

3.10 |

|

| 21RDD106 |

|

117.00 |

120.36 |

3.36 |

3.57 |

1.72 |

1.39 |

| Incl. |

118.76 |

119.43 |

0.67 |

12.30 |

4.80 |

|

| 21RDD107 |

|

|

No significant intervals |

|

|

|

|

| 21RDD108 |

|

12.00 |

26.29 |

14.29 |

0.46 |

0.37 |

|

| And |

164.63 |

168.50 |

3.87 |

1.30 |

0.89 |

0.72 |

| Incl. |

167.70 |

168.00 |

0.30 |

8.27 |

3.30 |

|

| And |

243.93 |

245.06 |

1.13 |

8.12 |

1.46 |

|

| 21RDD109A |

|

143.00 |

145.00 |

2.00 |

4.64 |

1.58 |

|

| And |

152.50 |

153.50 |

1.00 |

9.96 |

2.60 |

|

| And |

222.75 |

240.50 |

17.75 |

1.26 |

1.01 |

0.83 |

| Incl. |

223.50 |

226.00 |

2.50 |

3.92 |

2.91 |

|

| 21RDD110 |

|

65.00 |

80.00 |

15.00 |

0.42 |

1.09 |

|

| And |

229.90 |

234.00 |

4.10 |

1.21 |

1.32 |

1.05 |

| Incl. |

231.70 |

232.03 |

0.33 |

3.05 |

2.70 |

|

| And |

270.45 |

271.10 |

0.65 |

10.97 |

9.94 |

|

| And |

373.00 |

374.00 |

1.00 |

5.31 |

5.75 |

|

| And |

427.00 |

438.00 |

11.00 |

1.27 |

1.40 |

0.72 |

| Incl. |

427.50 |

428.00 |

0.50 |

12.70 |

9.90 |

|

| And |

462.00 |

466.50 |

4.50 |

2.52 |

1.10 |

1.09 |

| Incl. |

464.36 |

465.00 |

0.64 |

11.16 |

5.01 |

|

| And |

469.78 |

471.00 |

1.22 |

7.24 |

1.98 |

|

*Assay intervals reported are core lengths, true widths have not been determined

**Residual Au (g/t) – Average grade of the drill hole interval excluding the highlighted internal interval

Figure 8. Drill collar table from the 2021 summer-fall drill program

| Hole ID |

Easting (NAD83) |

Northing (NAD83) |

Elevation (m) |

Depth (m) |

Dip |

Azimuth |

| 21RDD081 |

519549 |

5620157 |

381 |

522.00 |

-45 |

316 |

| 21RDD085 |

518722 |

5620087 |

384 |

428.00 |

-45 |

173 |

| 21RDD088 |

518797 |

5620135 |

383 |

440.00 |

-46 |

174 |

| 21RDD089 |

519430 |

5620857 |

375 |

258.00 |

-50 |

160 |

| 21RDD090 |

519313 |

5620867 |

375 |

285.40 |

-45 |

334 |

| 21RDD091 |

519102 |

5620815 |

377 |

15.00 |

-45 |

144 |

| 21RDD091A |

519102 |

5620815 |

377 |

252.00 |

-45 |

144 |

| 21RDD092 |

518511 |

5619816 |

395 |

212.00 |

-45 |

155 |

| 21RDD093 |

519102 |

5620815 |

377 |

309.00 |

-58 |

144 |

| 21RDD094 |

519510 |

5620924 |

375 |

309.00 |

-46 |

158 |

| 21RDD095 |

518741 |

5619876 |

378 |

212.00 |

-53 |

155 |

| 21RDD096 |

519099 |

5620815 |

377 |

225.42 |

-45 |

167 |

| 21RDD097 |

519072 |

5620373 |

380 |

206.00 |

-56 |

152 |

| 21RDD098 |

519510 |

5620924 |

375 |

357.00 |

-58 |

159 |

| 21RDD099 |

519099 |

5620815 |

377 |

291.00 |

-58 |

167 |

| 21RDD100 |

519174 |

5620997 |

380 |

422.00 |

-45 |

158 |

| 21RDD101 |

519038 |

5620798 |

377 |

306.00 |

-45 |

170 |

| 21RDD102 |

519745 |

5621152 |

375 |

276.00 |

-45 |

327 |

| 21RDD103 |

519038 |

5620798 |

377 |

285.00 |

-58 |

160 |

| 21RDD104 |

519745 |

5621152 |

375 |

327.00 |

-60 |

327 |

| 21RDD105 |

519115 |

5620928 |

379 |

365.00 |

-50 |

150 |

| 21RDD106 |

519055 |

5620353 |

386 |

321.00 |

-45 |

359 |

| 21RDD107 |

519662 |

5621101 |

375 |

252.00 |

-45 |

333 |

| 21RDD108 |

519601 |

5621035 |

375 |

297.00 |

-56 |

339 |

| 21RDD109 |

519629 |

5620922 |

375 |

24.00 |

-50 |

160 |

| 21RDD109A |

519629 |

5620922 |

375 |

279.00 |

-50 |

160 |

| 21RDD110 |

519666 |

5621117 |

375 |

492.00 |

-50 |

158 |

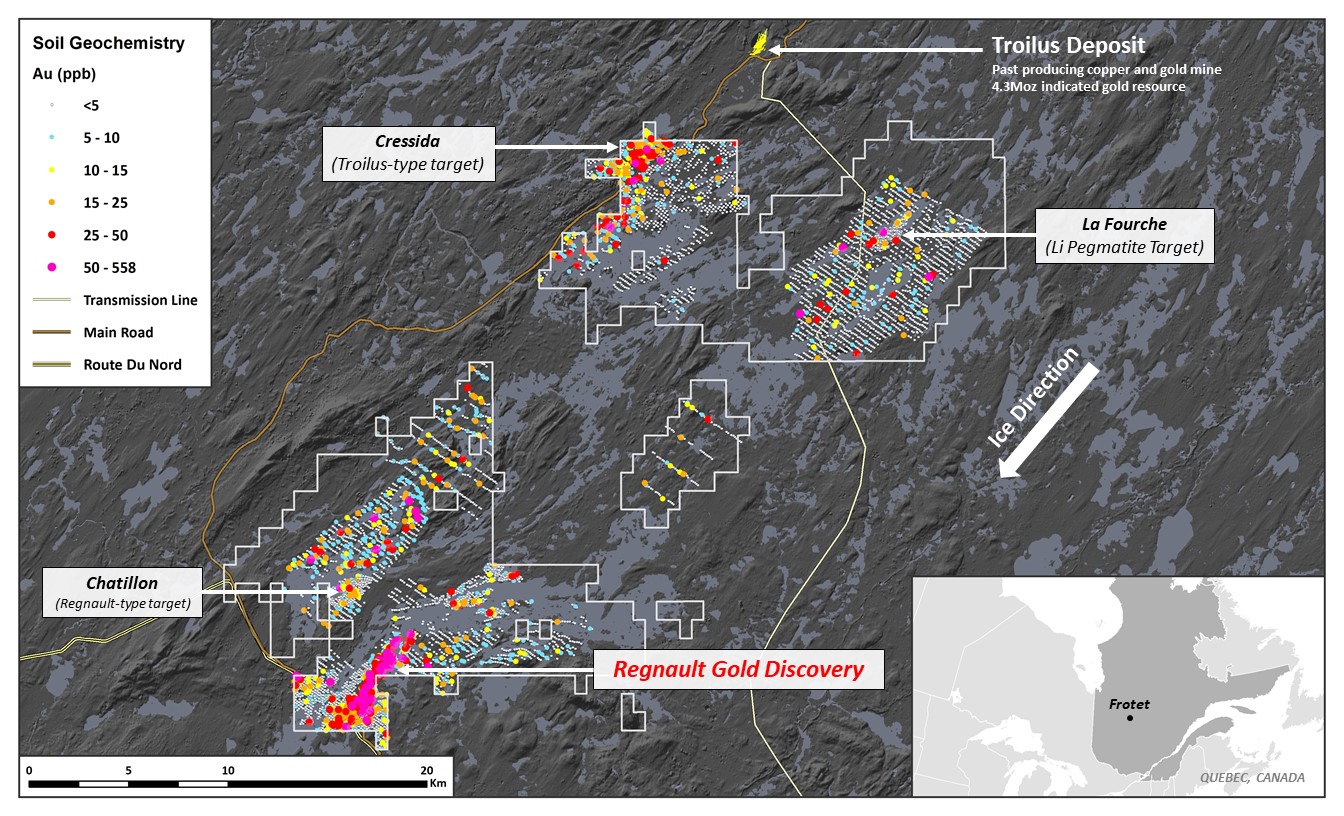

About the Frotet Project

The Frotet Project was first identified by Kenorland in 2017 after completing a regional prospectivity study over the Abitibi and Frotet-Evans Greenstone Belts of Quebec. The initial 55,921 ha property was acquired through map staking in March, 2017 and optioned to Sumitomo Metal Mining Canada Ltd. (“SMMCL”), a wholly owned subsidiary of Sumitomo Metal Mining Co., Ltd. in April, 2018. Two years of property-wide systematic till sampling led to a maiden drill program in 2020 which resulted in a significant grassroots discovery at the prospect now named Regnault. The project is currently under Joint Venture agreement between SMMCL and Kenorland Minerals Ltd., with interests being held at 80% and 20% respectively. Under the Joint Venture, exploration is funded pro-rata and Kenorland is presently the operator of the project. Any party which does not contribute and is diluted below a 10% interest, converts its interest to an 2% uncapped net smelter royalty.

Figure 9. Map of Frotet Project showing regional till sampling geochemical results

QA/QC and Core Sampling Protocols

All drill core samples were collected under the supervision of Kenorland employees. Drill core was transported from the drill platform to the logging facility where it was logged, photographed, and split by diamond saw prior to being sampled. Samples were then bagged, and blanks and certified reference materials were inserted at regular intervals. Groups of samples were placed in large bags, sealed with numbered tags in order to maintain a chain-of-custody, and transported from Chibougamau to BV laboratory in Timmins, Ontario.

Sample preparation and analytical work for this drill program was carried out by Bureau Veritas Commodities, Timmins, Ontario. Samples were prepared for analysis according to BV method PRP70-250: individual samples were crushed to 2mm and a 250g split was pulverized for analysis and then assayed for Gold. Gold in samples was analyzed by fire assay with AAS finish and over-limits re-analyzed gravimetrically. In zones with macroscopic gold the samples were first screened, and the fine fraction was fire assayed with AAS finish. Multi-element geochemical analysis (45 elements) was performed on all samples using BV method MA200 where a 0.25g split is heated in HNO3, HClO4, and HF to fuming and taken to dryness. The residue is dissolved in HCl and analysed by a combination of ICP-ES/MS. All results passed the QAQC screening at the lab, all company inserted standards and blanks returned results that were within acceptable limits.

Qualified Person

Mr. Jan Wozniewski, B. Sc., P. Geo., OGQ (#2239) is the “Qualified Person” under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

Investor Relations Agreement

Kenorland has entered into an investor relations agreement (the “Agreement“) with MI3 Communications Financières Inc. (“MI3″). The Agreement is for a term of one year, which may be terminated earlier at any time after December 31, 2020, upon 30 days’ written notice by either party. In consideration for the services of MI3, the Company has agreed to pay a fee of $3,000 per month. MI3 is not related to the Company and does not have any direct or indirect material interest in Kenorland or its securities.

Launched in 2007, MI3 is a Montreal-based new-age financial communication company geared for today’s fast-paced global economy. MI3’s services were developed to leverage the trading and market experience of our bilingual team to provide public relations, market-making activities and investor relations to Canadian public companies.

About Kenorland Minerals

Kenorland Minerals Ltd. (TSX.V KLD) is a mineral exploration Company incorporated under the laws of the Province of British Columbia and based in Vancouver, British Columbia, Canada. Kenorland’s focus is early to advanced stage exploration in North America. The Company currently holds four projects in Quebec where work is being completed under joint venture and earn-in agreement from third parties. The Frotet Project is held under joint venture with Sumitomo Metal Mining Co., Ltd., the Chicobi Project is optioned to Sumitomo Metal Mining Co., Ltd., the Chebistuan Project is optioned to Newmont Corporation, and the Hunter Project is optioned to Centerra Gold Inc. In Ontario, the Company holds the South Uchi Project under an earn-in agreement with a wholly owned subsidiary of Barrick Gold Corporation. In Alaska, USA, the Company owns 100% of the advanced stage Tanacross porphyry Cu-Au-Mo project as well as a 70% interest in the Healy Project, held under joint venture with Newmont Corporation.

Further information can be found on the Company’s website www.kenorlandminerals.com

Kenorland Minerals Ltd.

Zach Flood

CEO, Director

Tel: +1 604 363 1779

zach@kenorlandminerals.com

Kenorland Minerals Ltd.

Francis MacDonald

President

Tel: +1 778 322 8705

francis@kenorlandminerals.com

Cautionary Statement Regarding Forward Looking Statements

This news release contains forward-looking statements and forward-looking information (together, “forward-looking statements”) within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as “plans”, “expects’, “estimates”, “intends”, “anticipates”, “believes” or variations of such words, or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will be taken”, “occur” or “be achieved”. Forward looking statements involve risks, uncertainties and other factors disclosed under the heading “Risk Factors” and elsewhere in the Company’s filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.